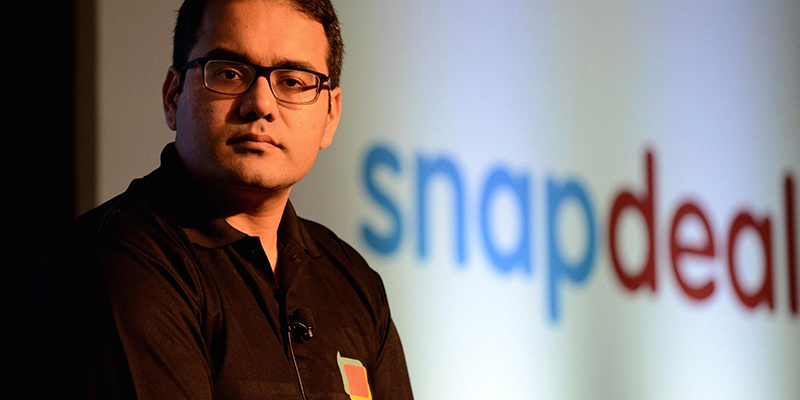

‘This Is The Best Time For Our Business’ Says Kunal Bahl

Kunal Bahl comments on the sale of Freecharge to Axis Bank, says it will provide Snapdeal the "necessary boost in resources" to continue its e-commerce journey.

Just hours after the deal was announced, Bahl wrote to employees seeking to assuage concerns saying Axis Bank intends to not just retain all Freecharge employees but also "invest significantly" in the team and brand.

His comments also assume significance amid reports that the Snapdeal board is leaning towards selling the e-commerce company to Flipkart.

Snapdeal earlier announced the sale of Freecharge to Axis Bank for $60 million, which was much lower than the price of $400 million for which it bought Freecharge back in 2015.

Bahl referred to the transaction with Axis Bank was "a great outcome".

"They intend to retain...