Uber to “Double Down” Investments in India after Leaving Southeast Asia

San Fransisco based cab hailing company Uber said on Wednesday that it would be doubling up investment in India to take on the arch contender Ola.

Uber's maiden COO Barney Hardford said that India has such a huge potential that the company would not settle for minority stake deals here.The world's most valued startup comments have come up amidst the speculations of a potential merger between its India unit and home built opponent Ola.

Hardford said,

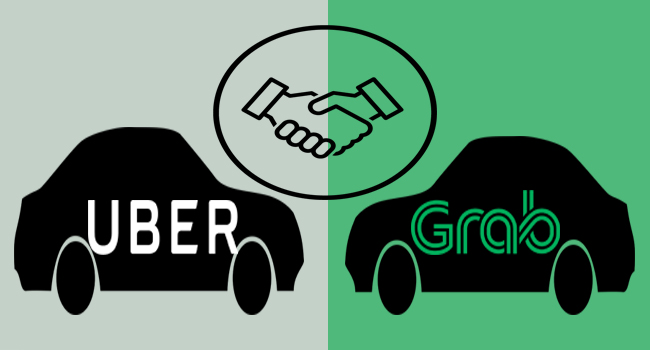

India is absolutely a core market, now and in the future. Uber's success is hardcoded to India's success. Our merger with Grab Holdings in Southeast Asia has freed up resources for the company to channelize into this market.

The company had set up a $1 billion investmnet in 2015 and also opened a support centre in Hyderabad with an inve...