Digital Payment News: Paytm Processes Rs 220 cr Payment, MobiKwik Tie-up With JNU, IIT-Delhi

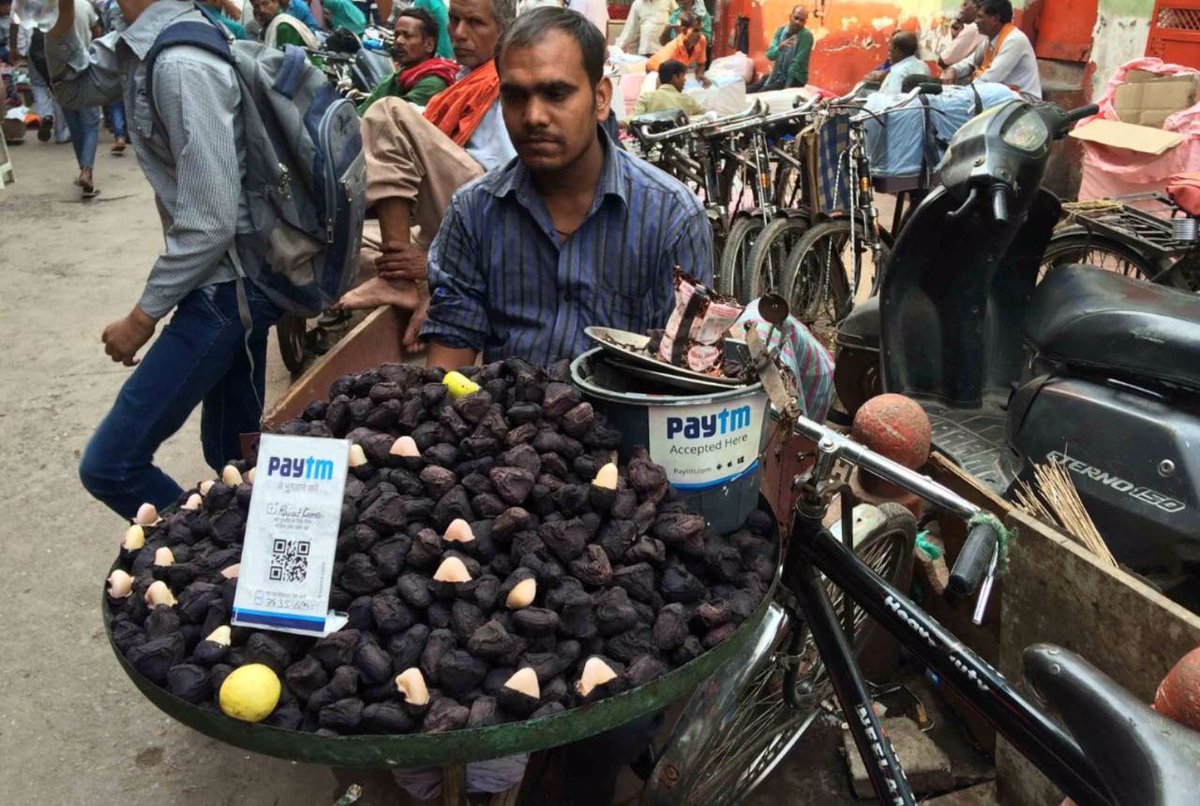

Digital payments platform Paytm today said it has processed sales of over Rs 220 crore at retail partner outlets during its four-day campaign.

The Alibaba-backed company registered three-time surge in payment transactions across offline partner stores during its 12/12 Cashfree Festival, processing over Rs 220 crore in retail sales at partner stores during four days (December 9-12), it said in a statement.

The company was processing over 3 lakh transactions per day in offline retail transactions worth around Rs 15-16 crore before the event, a company spokesperson said.

"During the festival, we processed more than one million transactions every day worth close to Rs 55-60 crore," she added. Paytm had partnered with several major offline stores including Big Bazaar, Pantaloons, Spenc...