India’s largest IT giant, TCS has now become the country’s most valued firm in terms of market capitalization as it market cap crossed the crucial USD 100 billion mark ( approximately Rs. 6.60 lakh crore) on Monday.

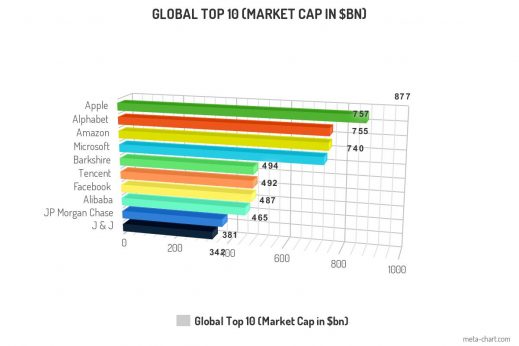

The company has successfully superseeded Accenture’s market cap which was at USD 98 billion. TCS’s market cap now stands at the zenith and exceeds more than that of all other IT companies together.

The company had become a USD 25 billion backed firms in 2010 and has never looked back since. It successfully crossed the USD 50 billion mark in 2013, followed by the USD 75 billion mark in 2004.

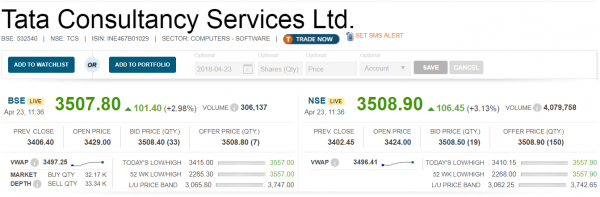

The upsurge in IT major’s script fortune has come just after it recorded a rise of 4.5 percent in Q4 profit.

To recap, In the first quarter of 2018 that ended March 31, the company has witnessed a net profit of Rs. 6,925 crore marking a growth of 4.57 percent against Rs. 6,622 crore of the last year.

Further, the company had announced a 1:1 bonus for its shareholders. This is the third time when TCS has its share offering by the company since its listing in 2004. Earlier, TCs had allocated 1:1 bonus shares in 2006 and 2009.

The company had also paid a dividend of Rs. 29 per share. The market analyst believes that this bonus offer is a tax-efficient way that rewards shareholders, as the Supreme Court Order has implied higher tax implications for the first half of bonus shares while the second half of the lot is tax-free.