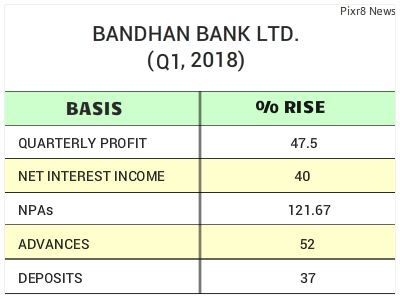

Bandhan Bank Ltd witnessed a powerful rise of 47.5% to Rs 481 crore in its quarterly profit because of the higher other income and net interest income. The shares of the bank rose to a record as its quarterly profit increased and asset quality remained stable.

Along with this, the net interest income, or the core income of the bank, rose 40% to Rs 1,037 crore. In the previous quarter, the Kolkata-based bank posted a net profit of Rs 327 crore. Gross bad loans as a percentage of total loans were recorded at 1.26% in this quarter, in comparison with 1.25% in the previous quarter and 0.93% a year ago.

“The start of FY19 has been promising with advances growing year-on-year by 52%, overcoming the seasonality we normally witness during the first quarter. We will strive to maintain growth and the quality of assets during this financial year,” said Chandra Shekhar Ghosh, managing director and chief executive officer of Bandhan Bank.

The interest received during the quarter was up about 35%. Gross non-performing assets (NPAs) rose 121.67% to Rs 388.34 crore at the end of this quarter from Rs 175.19 crore in the same quarter last year. Advances for the quarter increased 52% to Rs 32,590 crore, on the other hand, deposits rose 37% to Rs 30,703 crore.

Talking about the assets, Ghosh said, “Whatever NPAs we have are only in micro-credit segment. The NPAs have mainly come from our microcredit loans, but now that has been arrested. So we expect that our asset quality to improve moving forward.”

On Wednesday, Bandhan’s shares were trading at Rs 580.45 on the BSE, up 3.28% from its previous close, whereas the benchmark Sensex index fell 0.08% to 36,490.08 points.