Have you been trying to look into stocks of small companies that could yield good returns but failed to do so? Well, nothing to worry about, as we have got you covered with our list of top 5 small stocks that seem to be bursting with potential for offering better returns in 2018.

Though investors are usually apprehensive when it comes to dishing their money into small stocks, they can be profitable in the long run provided that they are chosen with care and self-analysis.

Why should an investor be optimistic regarding small stock investment?

Market analysts do not pay much heed to small stocks when it comes to investing in the share market. This is why it gets risky to invest in them. But thinking along a different perspective, the advantage of finding a hidden gem can be tremendous when a small stock might convert to a medium or large stock in no time offering excellent gains. Remember, platforms similar to Stocktrades are available and you can subscribe to them in order to have access to information that will help you make smarter investing decisions. This can be great if you are a novice to the investing world and are looking for support!

Gokul Raj P, executive director at HBJ Capital Services, says,

You can think of small stocks as plants that have just been planted to bloom. They would, hence, need their time to grow to be able to offer favorable future benefits.

- Small sized stocks in India are relatively less affected by internet tightening and other major factors.

- Moreover, inflation scenario in India nowhere appears to be benign.

- Oil prices too are expected to move up by a 10 to 15$ a barrel.Such factors will likely reduce RBI ability to keep in check with rates.It could lead to a rate hike.

Moreover, in the past years, we have seen business owners shifting to the idea of doing a clean and straightforward business rather than indulging in steps that could please markets unlike 2016-17 when business owners were more inclined to create market appeal without much cash flow.

Avanti Feeds

Founded in 1993, Avanti feeds is a leading firm involved in providing high-quality Fish feeds and also produces shrimp processors.It provides technical support to farmers and works in maintaining quality standards for global shrimp customers. It has a wide market spread across Europe, Japan, USA, Australia and the Middle East.

A close study of company’s financial data clearly reflects that it is in a growing phase and has a potential to perform well in India. With a P/E ratio a little high at 22 and a market cap of 12K crore, investors can look forward to it as a promising option.

Tracking in the past records, Avanti Feeds sets a perfect example of growth stock in India. During the last 5 years, it has observed a tremendous growth at an impressive cgr rate of 47% and 43% respectively. Moreover, the company is keen on acquiring a big billion dollar position by 2022 by reducing its dependence on shrimp feed sales is another trigger to invest in it.

Cyient

Cyient is a global service providing firm that focuses mainly on aerospace, engineering design, power generation and heavy engineering. It also caters to areas such as network, manufacturing, communications, and operations.Established in Hyderabad in 1991, Infotech Enterprises was rebranded at Cyient.

Currently, Cyient has a market cap of 6400 crores and its P/E ratio of 19.99 and appears a good option to invest keeping in mind small stocks.

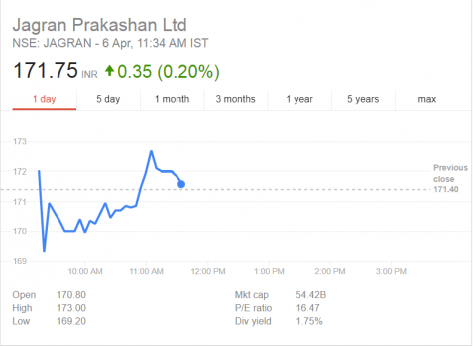

Jagaran Prakashan

A major media publication that leads in Uttar Pradesh, it currently has a market of 12 out of 15 as per the IRS Survey and leads ahead in the readership game by a whopping margin 0f 1.8 crores.

The company’s “Mid-day”, a Mumbai based evening newspaper and “Nai Duniya” plus its Radio business are also growing at an accelerated rate.The company seems to have a good future potential for growth.

- The shares of the company are currently open at Rs. 171.95 and have a P/E ratio of 16.2 which makes it quite attractive.

- With elections slated in different states this year, the readership might increase and this could give a good push to revenues.

- Also, with central elections to be held next year, the potential for growth in revenue cannot be ruled out.

Having some credible sources of cash generation, Jagran Prakashan stocks are likely expected to grow. With an EPS of 12 applying on p/e of 20 should take the stock rise up to 240 marks.

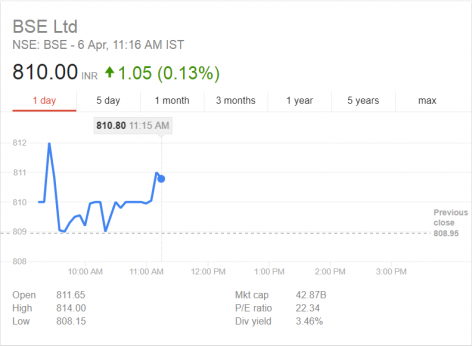

BSE Ltd.

One of the primeval stock exchanges in India, BSE working along Metropolitan Stock Exchange and NSE is responsible for controlling all trading related to stocks, currencies, and derivatives in India.

While BSE has considerably lost a tremendous amount to its derivative firm NSE, there are reasons to be optimistic about BSE earnings. There are two reasons for it. Firstly, the shares of the company are trending lower to Rs. 806 it’s IPO price.The shares at Rs.726 are also at a 52 week low.Moreover, the Indian market is increasingly showing interest in stocks.

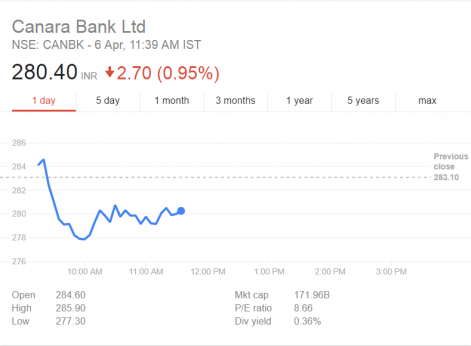

Canara Bank

The government has planned a recapitalization for Canara bank which can be considered a factor for its favorable growth.

Currently, with a robust 6100 branched networked, the bank has added 60 new branches for the quarter ending December 31, 2017. Even a small investor can go for a stock of Rs. 300 at least in the coming days.

Being a large size bank in the country, we believe that that worry’s over NPA will eventually subside and favorable push in the economy should work well for banks like Canara in near future.

Declamatory: We are not trying to promote companies or influence investor action through our write-up.The analysis has been done based on an expert prediction after an in-depth study of market factors. We advise readers to act at their own discretion and do a self-analysis too before going in for stock investment.