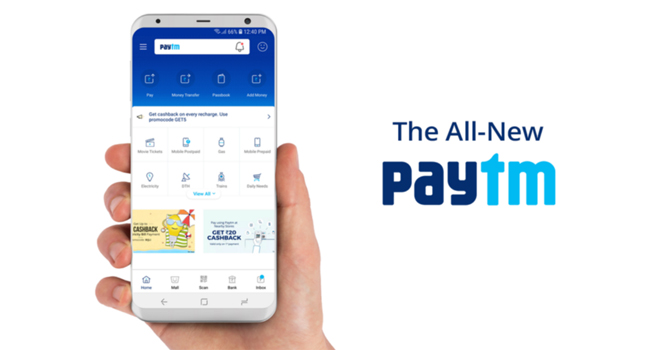

Paytm App Undergoes Major Makeover!

Paytm, the Indian payment gateway mammoth, has redesigned its app to make it more user friendly and spontaneous. The application update allows users to personalize the app and provide a better overall experience to the user by displaying the most used ways of customizing the app.

Transferring money is also something that the Paytm engineers worked heavily upon by making it easier, simpler and faster. Furthermore, now Paytm will also offer instant transfers from a user’s Paytm Payments Bank account or Paytm wallet to any other bank without charge. The major feature of this new look is the possibility to make bank-to-bank transactions under the section of ‘Money Transfers.’ The payment gateway app provisioned a budget of Rs 250 crore to endorse money transfers and presumes that this new o...