Amit Sinha Appointed as a Chief Operating Officer of Paytm Mall

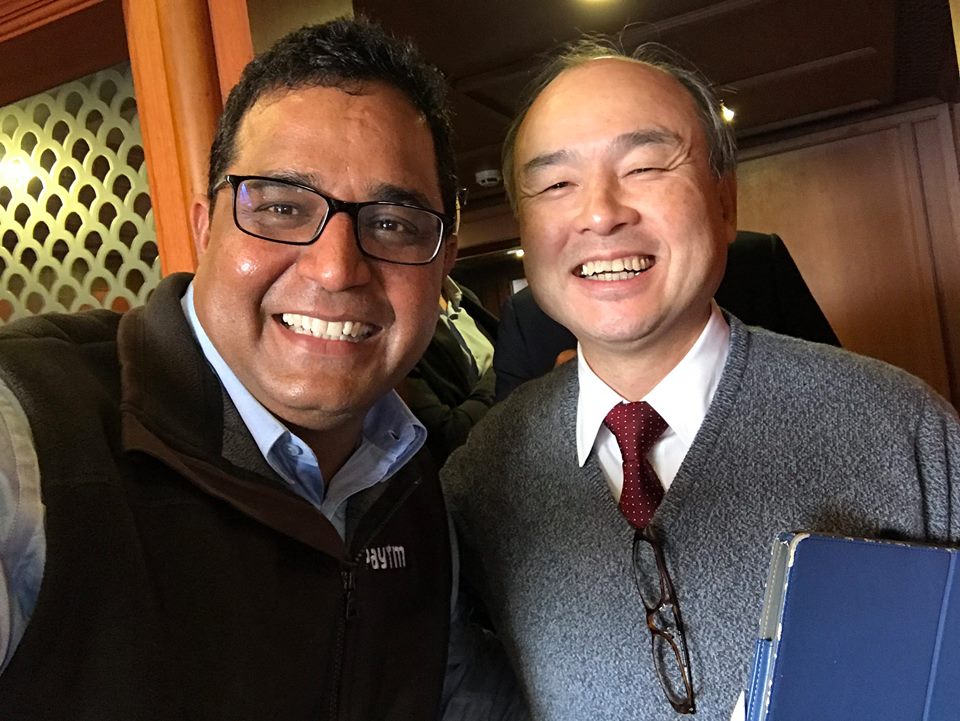

Amit Sinha has been appointed the Chief Operating Officer (COO) of Paytm Mall. He will now be responsible for its overall operations, including expanding its team to ensure customers across India are able to buy the widest range of products and accept deliveries through our efficient partner logistics network.

Amit was serving as the Sr. Vice President of Business in his earlier role. He has looked after HR & financial processes and has been with Paytm since 2008, helping build several new businesses.

“Our goal is to build the country’s largest platform that enables trusted partners including brand and merchants in growing their business. We are innovating on multiple aspects of business and offering newer business opportunities for sellers”, said Amit.

Paytm have de-merged it...