Finance Ministry Proposes Relaxations on LTCG Tax

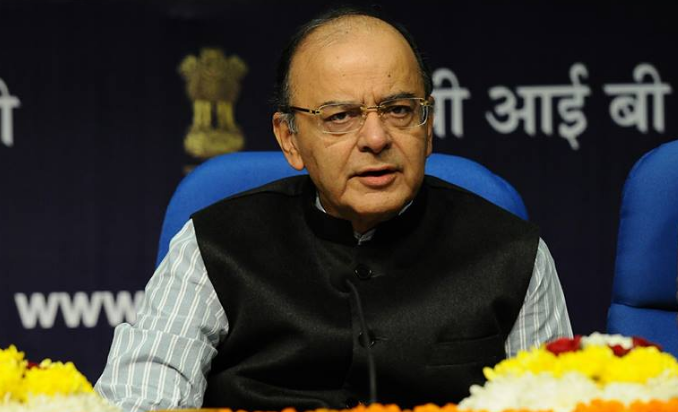

The Finance Minister, Mr. Arun Jaitely, has proposed to relax certain conditions for availing 10 percent concession on long-term capitals gain tax. The Ministry has invited stakeholders feedback on draft notification that lists out scenarios wherein individuals need not pay Securities Transaction Tax (STT) at the time of purchase for availing concessional tax rate.

In the 2018-19 budget, after a long gap of 14 years, the government reintroduced 10 percent on long-term capital gains exceeding Rs 1 lakh from the sale of shares.

The Central Board of Direct Taxes (CBDT) has clearly specified the nature of acquisitions with respect to which requirement of payment of STT will not be applicable for availing LTCG concessional rate.

Garima Pande, Partner and Business Tax Services...