$3 Billion Out of $6.25 Billion – The Online Investment From Chinese Investors in India

India has become an "action zone" for Chinese investors like e-commerce giant Alibaba as its market attracted second highest Chinese funding in IT products next to the US, state media reported today.

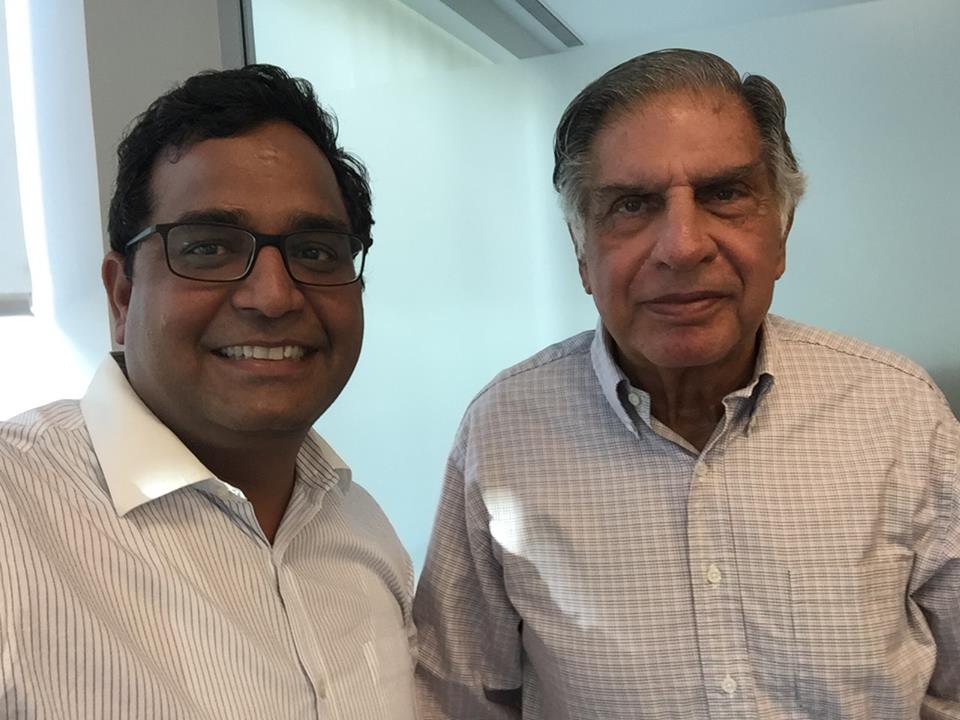

Citing the fast growth of Indias e-commerce website Paytm which provides services to 130 million people in India, a write-up in state-run China Daily said, "India is not just another developing country - it is the worlds fastest-growing economy".

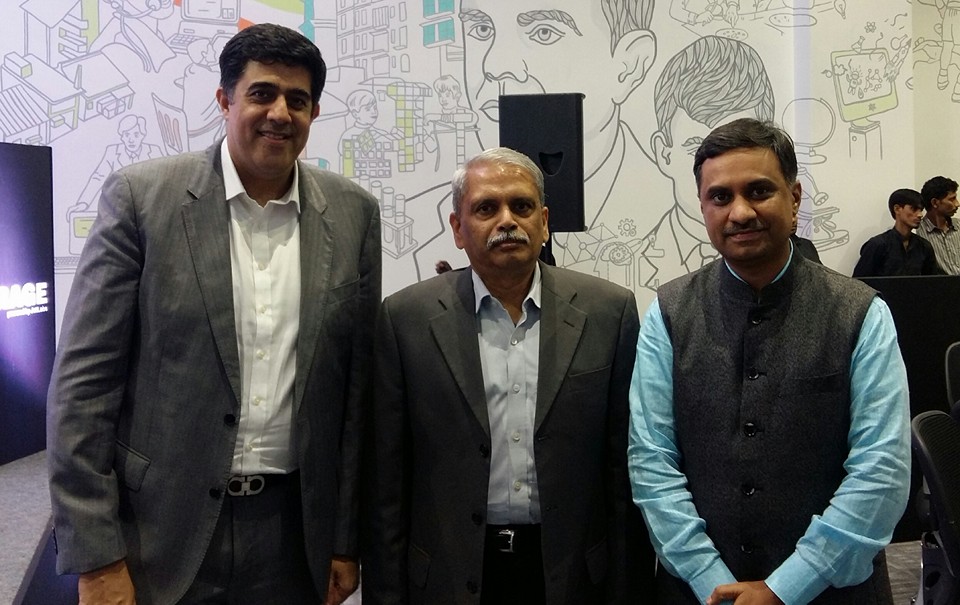

"A huge internet population, rapid growth of mobile internet users, political stability, established institutions like judiciary, a thriving start-up ecosystem, renowned IT expertise and the promising market potential... all these factors have made India an attractive, almost irresistible proposition for Chinese investors," the report said.

A...