MobiKwik Looking To Raise Fresh Funding in 3 Months

Digital payments firm MobiKwik today said it is looking at raising fresh funding in three months as it revs up expansion to compete head-on with rivals like Paytm.

The company, which has raised over USD 85 million in funding so far, also expects to break-even by middle of next year.

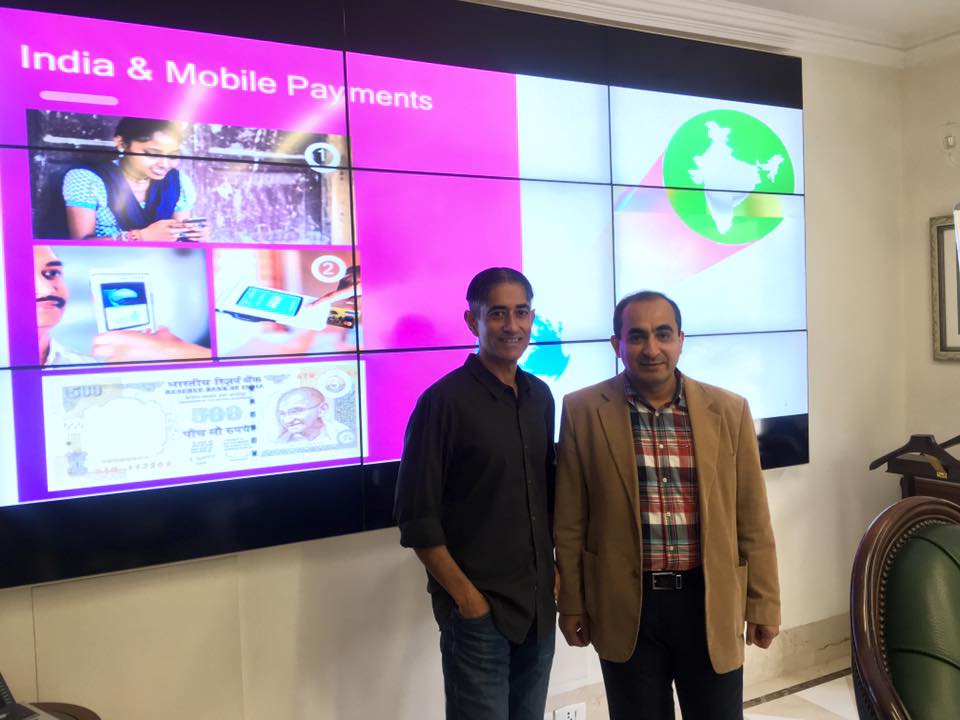

"We are looking at raising a decent amount of fund. While we are well-capitalised at this time, fresh funding will help us expand our customer base of merchants and consumers. We have grown at a massive pace in the weeks after demonetisation and the funds will help us strengthen our operations and expand," MobiKwik founder and CEO Bipin Preet Singh told PIXR8.

He, however, declined to comment on the amount being raised as the discussions are still on. "We are talking to both new and existing investors....