Less than 2% of the Indians know where to invest, and the rest need guidance and advisory support to plan their financials. While Dinesh Rohira was working at Microsoft, he had conceptualized and delivered an online platform for distribution of all investment products.

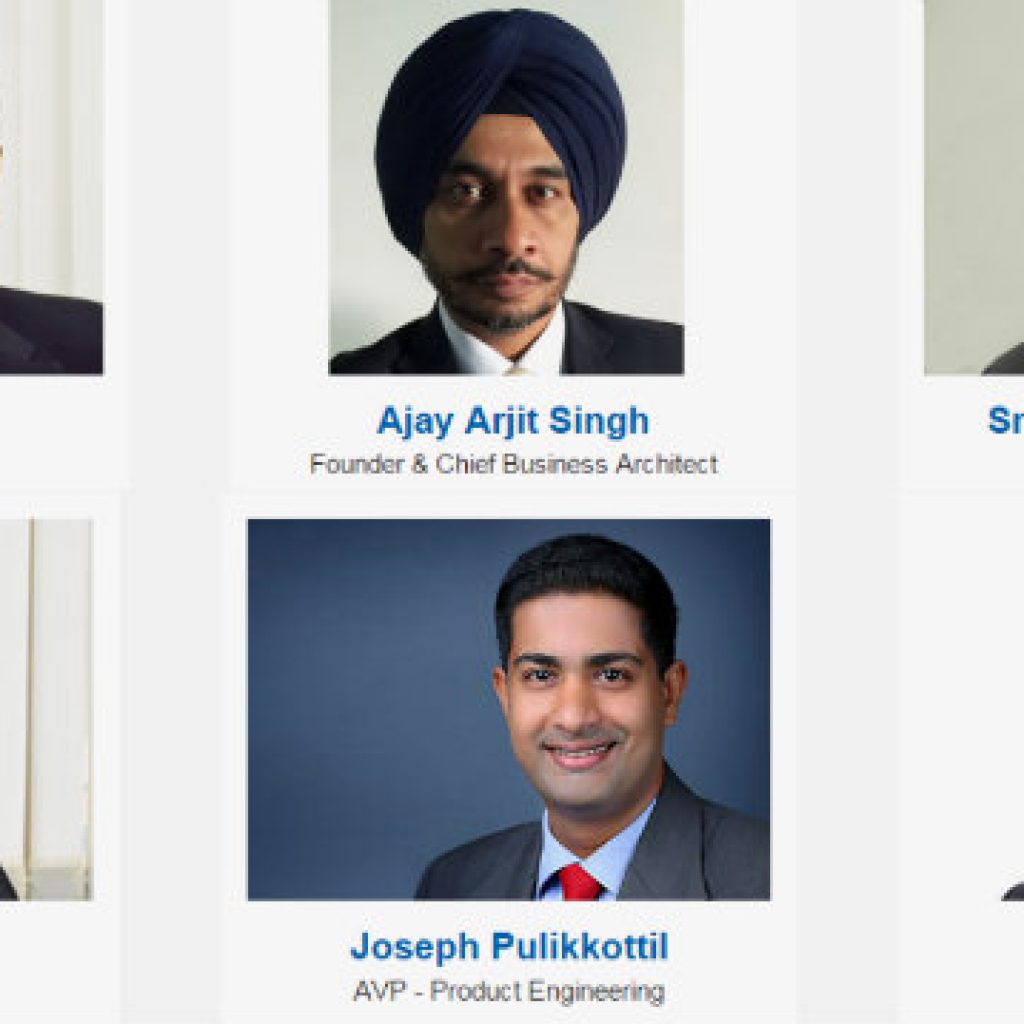

“This triggered the idea of financial planning to be provided via a technology platform that can address the masses (the 98%) who don’t know much about investments,” says the founder Dinesh. He started up 5nance.com with Ajay Arjit Singh to solve the problem of money management.

All our personal experiences and financial decisions are taken basis an excel sheet. It becomes the most enabling factor towards all our personal finances. The same was experienced by the founders which made them start a Proactive Money Management company for the masses. While the parent company Innovage Fintech Pvt Ltd. had started in 2010, 5nance was started in Nov 2015 only. Based out of Mumbai, the company conceptualized a platform that provided financial advice to the consumers. The company made advisory services available for free, which enables the consumer to explore easily.

“We wanted to enable the change of moving from investments which are traditionally done through an offline intermediary (a known person) to an online platform. Moving financial and money management decisions to an online automated platform, for masses, required some motivation for the users to appreciate and experience the value, hence we chose to remove all entry barriers for the same,” says the founder Ajay.

This also helped them with regard to competition, apart from the significantly large value created out of a data driven, analytics focused platform.

There are many Investment advisory companies in the offline world, and there are some in the online world as well. But 5nance has stood apart from all of them by being a ‘One Stop Shop’ for all money management needs. “We take care of Budgeting, Goals Planning, Advisory, Transactions, and Portfolio Management. All of this is integrated and automated on a single platform. Apart from this, we are focusing on providing all the financial instruments that a user needs, be it assets or liabilities on our platform,” says Dinesh, an alumnus of VJIT Mumbai. Currently they have enabled Mutual Funds, Corporate Deposits, Gold, Bonds, Loans, and Credit Cards.

They are targeting to add Direct Equities, Insurance and add more manufacturers among the existing instruments in the next 3-4 months. So a user can do all the planning & execution on a single platform. For the user 5nance.com, this pain point of owning the financial planning & money management challenge is completely addressed and that too with the control being with them. We are aligned purely on the user and not on the financial product, as is the case with the other players in the market.

Their model involves offering all financial instruments to our consumers be it assets or liabilities. To foster this, they are partnering with most of the leading manufacturers from all financial instruments. Leading players such as ICICI, HDFC, Reliance, Kotak, Axis, Birla, DHFL and many more. About 40+ leading manufacturer offerings are available on their platform. This 35 member team looks to grow to over 100 people in the next 1 year. The start-up has raised USD 3 Mn in their angel round of funding.

“The current business model is Phase 1 of our business model which is targeting the mid-income group segment of USD 10K to USD 100K in annual earnings. We will be rolling out advanced services for this segment in the next 3 months timeframe, whereas Phase 2 targeting USD 100K to USD 500K in annual earnings will be come out in 6 months and Phase 3 targeting USD 500K to USD 1 Mn will be in 10-12 months’ timeline,” says Ajay, who was also a gold medallist at NIT Jalandhar.

The founders recommend the future entrepreneurs to assess and be critical about their idea and business model to be capable of scaling up significantly. “Look for partners, don’t try to do it alone. If you are trying to do it alone it will take it much longer,” adds Rohira. “However when selecting or looking for partners, be sure they share the same level of passion and commitment towards the business model,” adds Singh.