Facebook has smashed investors’ expectations with a 52 per cent jump in quarterly revenue as it sold more ads targeted at a fast-growing number of mobile users, sending its shares sharply higher after hours.

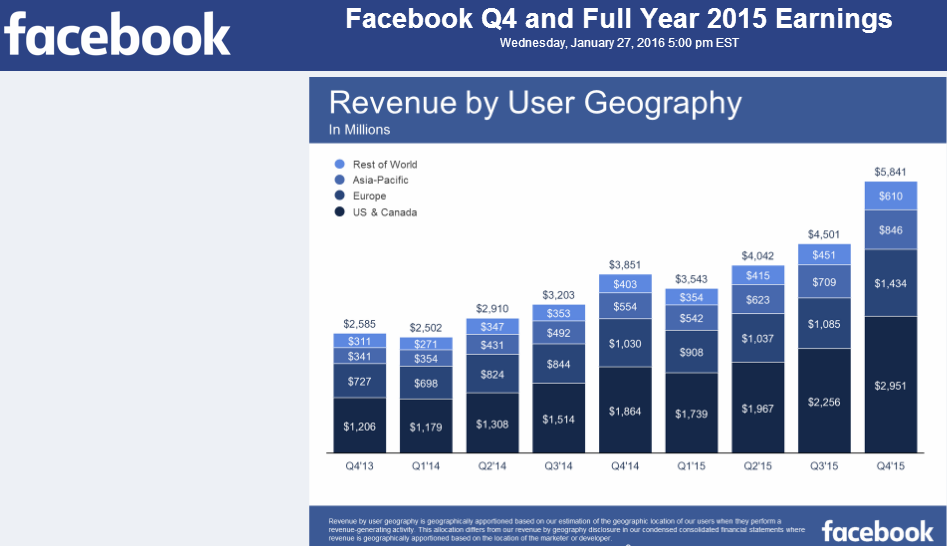

The world’s biggest online social network bucked the trend of underwhelming tech results from Apple and eBay, in the face of economic turmoil in China and a strong US dollar depressing the value of overseas sales. Facebook’s service is not available in China but it sells ads there.

“It’s phenomenal at these (currency headwind) levels that they’re accelerating to that level of growth,” said Rob Sanderson, an analyst at MKM Partners.

“I don’t think there’s going to be too many people crying for them to start monetising other properties anytime soon because the core business is so strong.”

Facebook shares rose more than 12 per cent in after-hours trading to $US106.51.

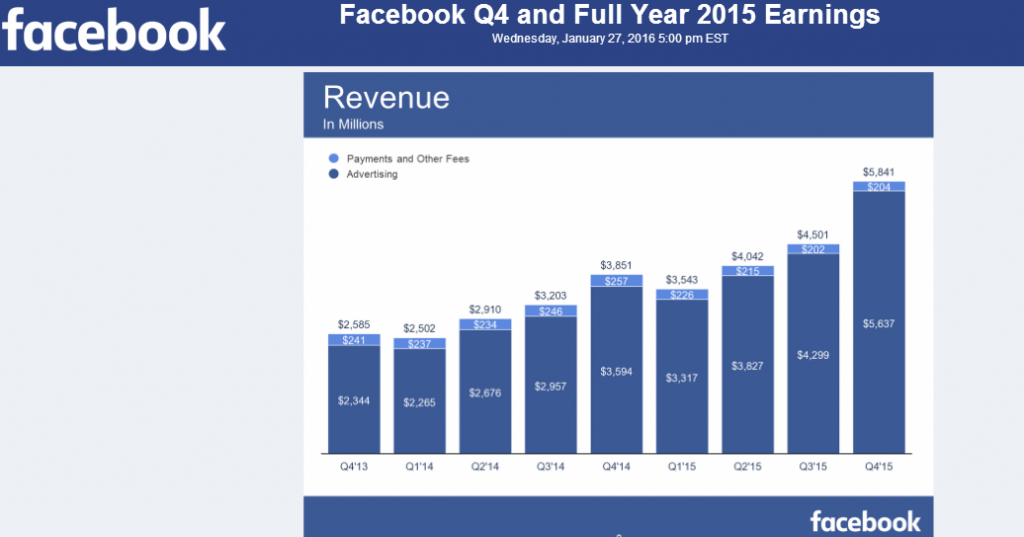

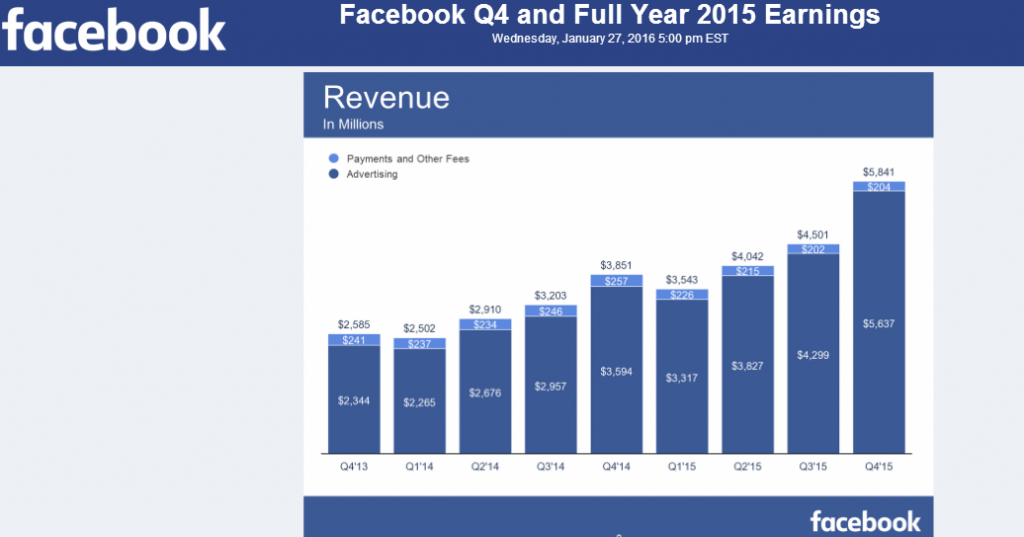

Total revenue rose to $US5.84 billion ($A8.29 billion) from $US3.85 billion a year earlier, with ad revenue increasing 56.8 per cent to $US5.64 billion in the holiday shopping period, when spending on advertising typically spikes. Excluding some items, the company earned 79 US cents per share.

Analysts on average had expected earnings of 68 US cents per share and revenue of $US5.37 billion.

Apart from focusing on mobile, Facebook has been ramping up spending on what it calls “big bets”, including virtual reality, artificial intelligence and drones to connect the remotest parts of the world to the internet.

Chief executive Mark Zuckerberg, who returned from two months of paternity leave on Monday, has said virtual reality represents the next major computing platform.

In January, Facebook began taking orders for a consumer version of the Oculus Rift, a head-mounted virtual reality unit.

The company has also begun monetising some of its other units, such as photo-sharing app Instagram, which surpassed 400 million users last year and began selling ads in September.

Facebook said mobile ads accounted for 80 per cent of total ad revenue in the quarter, compared with about 78 per cent in the third quarter and 69 per cent a year earlier.

“It’s much stronger ad growth than we were expecting,” said Ken Sena, an analyst at Evercore ISI.

“It signifies the importance of what they’re providing to advertisers,” he said. “They’re making big investments and evidenced by their quarterly performance it seems to be working.”

The company, which has the world’s most popular smartphone app, has also been benefiting from a surge in video views that has attracted advertising dollars.

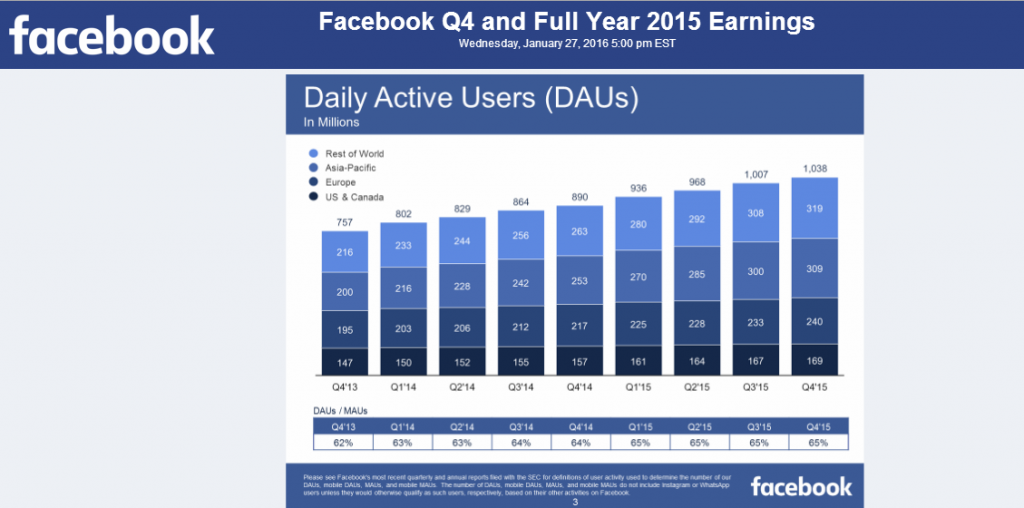

Facebook said it had 1.59 billion monthly active users as of December 31, up 14 per cent from the end of 2014. Of those, 1.44 billion used the service on mobile devices, an increase of 21 per cent.

Analysts had expected the company to report 1.58 billion monthly active users, with 1.43 billion accessing the service through smartphones and tablets, according to market research firm FactSet StreetAccount.

Up to Wednesday’s close at $US94.45, Facebook’s stock had risen nearly 25 per cent in the past 12 months.