With slump in Oil and Gas sector in the past few years, the vehicle leasing industry have been increasingly focusing on non-oil sectors such as FMCG, Telecom, Healthcare, Logistics, Construction to boost their revenue and expand market share.

For more information

Kuwait Long Term Vehicle Leasing Market

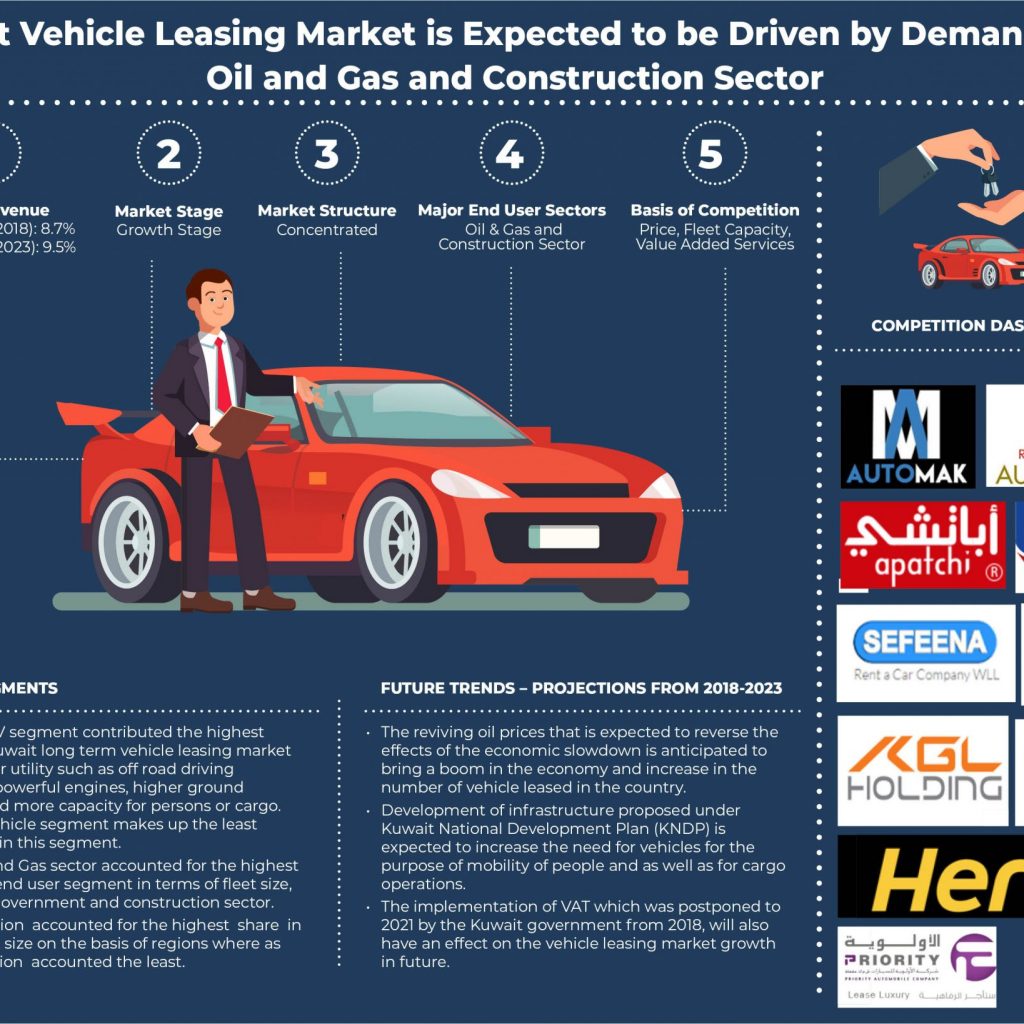

During the period 2013-2018, Kuwait vehicle leasing market grew at a positive growth rate. There were several factors that influenced the growth such as growth of end user industries, increase in number of new establishments, focus on non-oil sector end users and other factors. The growth in non-oil sector/industries and stable construction projects in the country positively influenced the vehicle leasing market to a large extent. The industry witnessed overall increase in fleet size owing to growing competition, increasing demand and increasing market penetration across various regions in the country. Increasing competition in the market has raised the quality of services offered by vehicle leasing companies in the country, which has attracted more number of customers to gradually avail the services for their mobility needs. The reviving oil prices will act as a stimulant to the growth of vehicle leasing, as the revival in oil prices would reverse the cost cutting measures taken by the oil and gas companies in the years 2014-2016.

Kuwait Long Term Vehicle Leasing Market Segmentation

By Type of Vehicle: As of 2018, the luxury vehicle segment accounted for the least share in terms of fleet size. These vehicles are expensive and have a niche market. The SUV/MUV segment contributed about the highest in terms of revenue, owing to the Kuwait government’s preference for an SUV in their fleet due to ease in travel while in off roads locations and availability of different variants such as 4 cylinder, 6 cylinder, 8 cylinder. The Sedan segment contributed highest share in terms of fleet size and second highest in terms of the market revenue as of 2018. These vehicles were majorly used for employee mobility, the sedan is an evergreen segment used by corporate and individuals, and lastly, the Pickup segment also showed significant growth in the market. The demand for this segment has been on the rise and these types of vehicles are designed for cargo transportation which is being used by the logistics and construction sector in Kuwait.

By Regions: Kuwait is divided into 3 regions namely Northern, Central, and Southern. In 2018, Southern region accounted for highest share in terms of fleet size due to presence of oil and construction industries. Central region also accounted for a significant share in the total fleet size, owing to presence of various branches, headquarters of companies in the region and as well as presence of residential areas in the region.

By End Users: Oil and Gas have accounted for highest share in the total fleet demand mainly because the country’s economy depends on oil, and it is the largest spending sector on vehicle leasing for the purpose of employee mobility. The government and military sector that includes the ministries of Kuwait such as ministry of public works, ministry of education have also increased the demand for vehicle leasing. The construction sector also constituted a significant share and use vehicles meant for transportation of employees and cargo. Others include individuals and other industries which accounted for a small share in the market in terms of fleet in the Kuwait vehicle leasing market.

By Type of Vendor: In 2018, the vehicle leasing companies had captured the majority of the market share due to their willingness and ability to lease, service, maintain, and repair the vehicles from various brands. The automotive dealers lag behind the core vehicle leasing companies in terms of fleet size as of 2018.

By Duration: Three year lease duration has been the most popular as the lease prices are low and the vehicle leasing companies also prefers to lease vehicles for this duration, as it is difficult to sell the vehicle after it has been in use for 4 years or longer.

Competition in Kuwait Vehicle Leasing Market

The competition in Kuwait has intensified over the years, with new vehicle leasing companies entering the market and with the increase in price transparency in the industry, the lease/contract prices of companies have decreased causing the profit margins to decrease as well. Furthermore, the competition landscape has changed from the time when two companies namely Al-Sayer, (an exclusive dealer of Toyota) and Al Mulla had the majority of the market share. Additionally, with the emergence of companies such as Automak, Autolease (KAICO), and Aayan Auto, the competition evolved to being competitive pricing strategy with core focus on consumer satisfaction by providing value added services. Besides the price factor, consumers are giving utmost importance to services such as vehicle portfolio/variants, routine service and maintenance facility of the vehicle, road side assistance, comprehensive insurance, and replacement vehicle, if necessary.

Future Outlook of Kuwait Vehicle Leasing Market

Kuwait vehicle leasing market is projected to increase significantly in the forecasted period, 2018-2023. The average lease price is expected to decrease in the country with rising competitive rivalry. If you look for business lease contracts, the profit margins of the vehicle leasing companies are expected to decrease over the next 5 years due to companies further engaging in price war strategy. The SUV/MUV segment will see an increase in their share of fleet over the forecasted period, 2018-2023 due to the increase in customer preference owing to benefits such as vehicles functionality for off road driving, strong built and room for more passengers or cargo. Northern region will witness high growth rate as the government of Kuwait plans to develop the region further in terms of infrastructure and economic activities and also encourage establishment of new businesses and attracting foreign investments in the region.