City based micro-lending platform KrazyBee, primarily focused towards purchase finance, today said it has raised $8 million in a Series A financing, led by Xiaomi Technologies and Shunwei Capital.

Others who participated in the investment are E-city Ventures and RK Group and the Series A funding is a mix of equity and debt (majorly equity), the company said in a release. Total composite funding received by KrazyBee till date is USD 13 million that includes a Seed Fund of USD two million and Pre-Series A funding of USD three million.

The latest round of funding will be used to strengthen the risk model and algorithm, catering to new market segments and focusing on product diversification and geographical expansion in existing segments, KrazyBee said.

“We are actively working towards a risk algorithm that helps us achieve a system-generated decision on every profile, and we are optimizing that further in terms of efficiency & accuracy. “Also, being in the Fintech space, compliance is the key and hence we follow all the regulations very strictly,” KrazyBee Founder and CEO Madhusudan said.

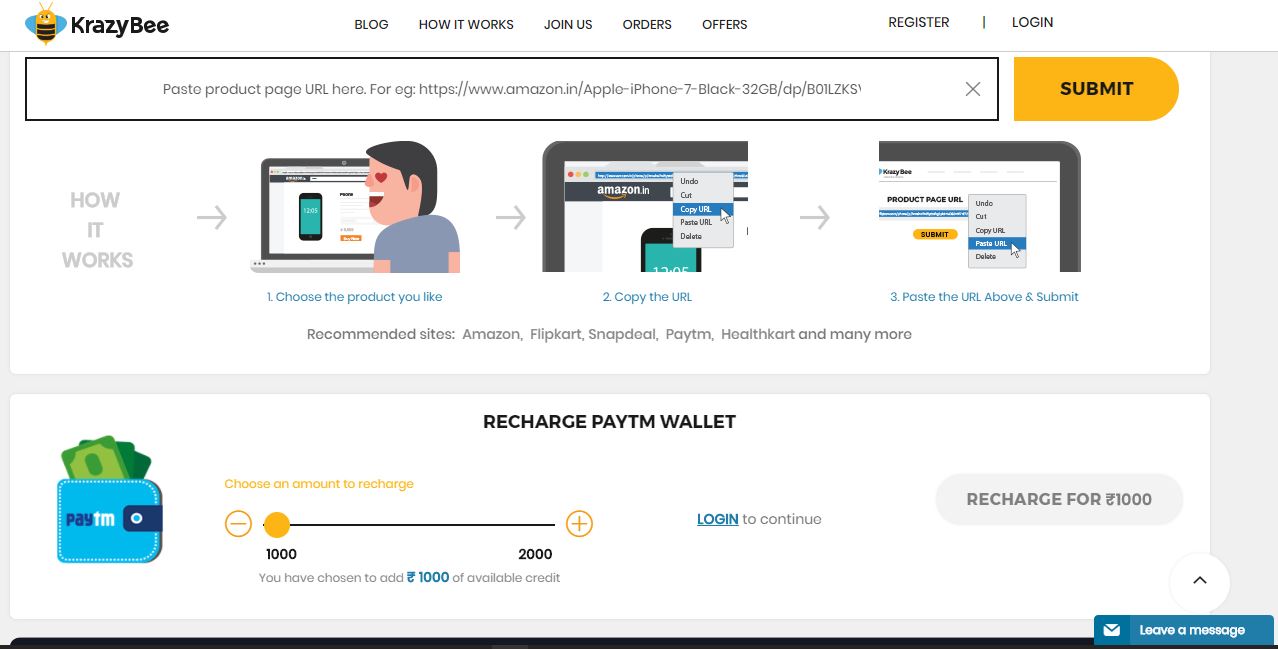

KrazyBees current portfolio includes e-commerce purchase, cash credit, two-wheeler credit, college semester/ tuition fees credit among others. Its current segment being served comprises of young professionals and UG/PG students under the age of 30.

ALSO READ

Be Intellectually Honest And Have The Courage To Change Says Apple CEO Tim Cook

Amazon Studios Chief Roy Price Suspended Following Harassment Allegation

The company claims that it currently has more than three lakh registered users, of which over 50,000 active confirmed users regularly use the platform.

The micro-lending platform that got an NBFC (Non-Banking Financial Corporation) License from Reserve Bank of India earlier this year said it has been operating across Bangalore, Hyderabad, Pune, Mysore and Vellore and has recently expanded to Mumbai, Chennai, Coimbatore, Nagpur, Nashik and Manipal.