Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Honourable Prime Minister of India, Mr Narendra Damodardas Modi on April 8, 2015.

If you own a small business and want to have sufficient funds to make your business grow and flourish and need a strong financial backing? Then this scheme may help you grow.

The aim of the scheme is to provide loans up to 10 lakh to the micro units that is the non-corporate, non-farm small enterprises who have the potential and ability to grow but lack financial support. Micro-units include all the small organizations, companies and start-ups in India. The Mudra Loan cannot be taken for personal requirements, educational assistance, personal vehicle or by rich businessmen.

The most common examination of the micro-units is that they lack adequate funds to financially support and grow their business. And therefore, MUDRA or Micro Units Development & Refinance Agency Limited was set up by the Government of India to facilitate growth & prosperity in business and refinance activities relating to these micro-segments.

The lack of formal financing hampers the growth of small businesses and makes them ineffective at competing with the larger entrepreneurs. To remove this bottleneck, MUDRA Bank has been set up as a subsidiary of SIDBI.

TYPES OF MUDRA LOAN ONE CAN AVAIL

The loans provided under MUDRA are known as the ‘Mudra Loans’ which can further be divided into three categories,

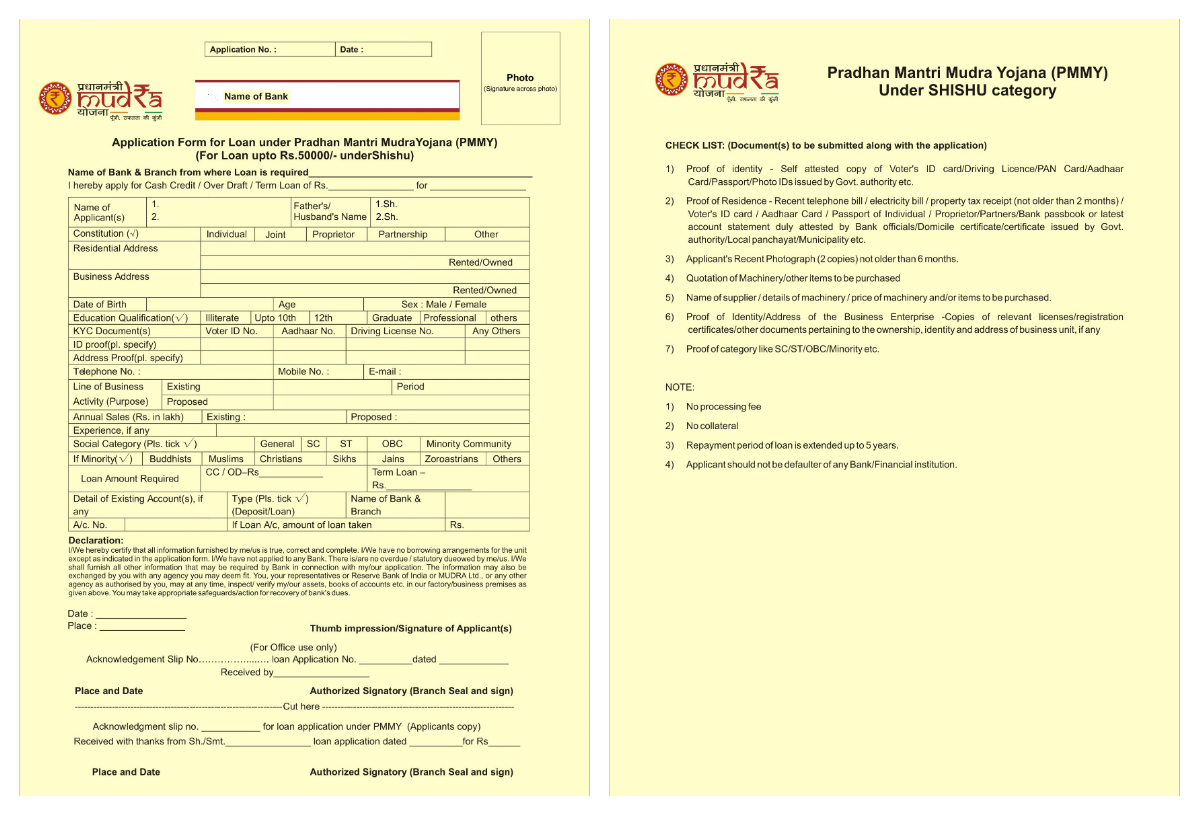

1. SHISHU (CHILD) LOAN –

The category covers loans amounting up to Rs.50,000. It is basically for the start-ups that are at their primitive stage or those who require fewer funds to start their business.

2. KISHOR LOAN –

This is the category where the loan covered ranges from Rs.50,000 to Rs.5 lakh. It includes those enterprises whose business has started but it is yet to be established.

3. TARUN LOAN –

This category covers loan ranging from Rs.5 lakh to Rs.10 lakh. It includes those businessmen who have started their business and established themselves but need financial support to expand their business, to buy assets, technological advancements etc.

ELIGIBILITY FOR MUDRA LOAN

If you’re wondering what will make you eligible for the Mudra Loan, we’ll further talk about the eligibility criteria for it. The terms and conditions are ought to be followed by the borrowers in order to avail loans under MUDRA. The eligibility criteria goes as follows:

1. Only the Indian Businessmen can obtain a Mudra Loan.

2. The business plan must be from the non-farm and non-corporate sector with credit requirement of less than Rs 10 Lakhs.

3. The age of the applicant should be 23 years to 28 years at the time of the loan sanction and should not be more than 65 years at the time of the loan maturity.

4. In case of the salaried group, the minimum occupational stability should be 2 years and business stability should be at least 5 years with 3 years’ service stability for doctors.

5. The applicant should have monthly income above INR 17000 or INR 15 lakhs or more as annual turnover. The minimum profit after tax for non-individuals should be INR 1 lakh per year and for proprietorship/self-employed, it is INR 2 lakhs.

6. Applicants either have to have spent a year in the current residence or have a 1-year service relationship with the bank through which they are applying for the loan.

But before applying for the Mudra Loan, the applicant should know that the funds through this loan can only be invested in business activities. Therefore, the borrowers of the Mudra Loan must be under the following categories:

⦁ Textile Products Sector – This sector includes handloom, power loom, zari and zardozi work, traditional embroidery and handwork, traditional dyeing and printing, apparel design, knitting, cotton ginning, computerized embroidery, stitching and other textiles, non-garment products such as bags, furnishing accessories, etc.

⦁ Land Transport Sector – This sector included business related to purchase of transport vehicles for goods and personal transport such as auto rickshaw, small goods transport vehicle, 3 wheelers, e-rickshaw, passenger cars, taxis, etc.

⦁ Food Products Sector – Undertaking activities such as small service food stalls and day to day catering/canteen services, achaar making, jam/jelly making, agricultural produce preservation at rural level, sweet shops, dairies, cold storages, ice cream making units, biscuit, bread and bun making, etc come under this category.

⦁ Community, Social & Personal Service Activities – This category includes saloons, beauty parlors, gymnasium, boutiques, tailoring shops, dry cleaning, cycle and motorcycle repair shop, Photocopying Facilities, Medicine Shops etc.

Not only the loan raisers but also the lenders have to follow some rules and regulations based on certain criteria. Since MUDRA is a refinancing institution, loans are not offered directly by MUDRA but through existing NBFCs, Financial Institutions, Banks, Primary Lending Institutions, etc.

⦁ To be eligible to lend loans, the rural banks must have a net NPA within 3%. They must also have a profitable operation and not hold any accumulated losses and CRAR more than 9%.

⦁ The scheduled commercial banks in public and private sector must have a minimum net worth of Rs.100 crore and not less than 9% CRAR. It must carry 3 years of continuous track record and net NPAs should be less than 3%.

⦁ Micro Finance Institutions and Small Business Companies are eligible if they fulfill the requirements.

The following are the top Banks and Financial Institution providing MUDRA loan in India.

|

BANK NAME |

LOAN ACCOUNTS |

| · UCO Bank | 4,79,476 |

| · State Bank of India | 4,67,062 |

| · Canara Bank | 3,35,270 |

| · Bank of India | 2,73,784 |

| · Syndicate Bank | 2,14,228 |

| · Indian Bank | 1,90,129 |

| · Punjab National Bank | 1,83,594 |

| · Bank of Baroda | 1,20,010 |

| · Central Bank of India | 1,11,820 |

| · Allahabad Bank | 1,10,044 |

| · HDFC Bank | 5,57,41 |

| · IndusInd Bank | 4,95,954 |

| · Axis Bank | 4,36,323 |

| · ICICI Bank | 34,311 |

| · Ratnakar Bank | 28,408 |

| · Yes Bank | 9,627 |

| · Karnataka Bank | 4,958 |

| · Karur Vysya Bank | 3,222 |

| · South Indian Bank | 2,368 |

| · Lakshmi Vilas Bank | 1,449 |

| · Uttar Bihar Gramin Bank | 1,11,509 |

| · Pragathi Krishna Gramin Bank | 70,892 |

| · Karnataka Vikas Grameena Bank | 46,549 |

| · Kerala Gramin Bank | 44,525 |

| · Madhya Bihar Gramin Bank | 34,928 |

| · Baroda UP Gramin Bank | 32,743 |

| · Baroda Rajasthan Ksethriya Gramin Bank | 29,913 |

| · Andhra Pragathi Gramin Bank | 24,834 |

| · Pallavan Grama Bank | 22,926 |

| · Allahabad UP Gramin Bank | 22,618 |

HOW TO APPLY FOR MUDRA LOAN

The businessmen and entrepreneurs who wish to raise the Mudra loan for business finance can proceed towards the local branch of any of the financial institutions mentioned above, in their region. The borrower will have to present the business idea with the loan application form along with the other documents required. They have to fill up all the formalities as per the bank instructions. However, the authorization of the financial assistance shall be as per the eligibility criteria of the respective lending institution.

The following documents are required to be submitted for the same-

1. IN CASE OF VEHICLE LOAN –

– The Pradhan Mantri Mudra Yojana application form duly filled

– Photo identity proof, address proof and income proof

– 2 passport sized photos of the borrower

– The vehicle loan application form that is duly filled.

– Last 6 month’s bank statement

2. IN CASE OF BUSINESS INSTALMENT LOAN –

– Pradhan Mantri Mudra Yojana application form duly filled

– Business Instalment loan application form duly filled

– Photo identity proof and address proof

– Proof of establishment

– Last 6 month’s bank statement

– Qualification proof

– Trade references

– Ownership proof or office and residence

– Proof of continuity of business

3. IN CASE OF BUSINESS LOANS GROUP AND RURAL BUSINESS CREDIT –

– Pradhan Mantri Mudra Yojana application form duly filled

– Business Instalment loan or Rural Business Credit application form duly filled

– Photo identity proof, age proof and address proof

– Ownership proof of residence or office

– Last 12 month’s bank statement

– Last 2 years Income Tax Return document

– Business vintage proof

MUDRA CARD

When the borrower passes all the eligibility tests, they are provided the Mudra Card. The Mudra Loan is offered in the form of a MUDRA card wherein the borrower can utilize the credit amount in a convenient and flexible manner through a RuPay card. The card, on one hand, acts as a credit card with a pre-approved loan amount and on the other hand, acts as a debit card allowing the borrowers to withdraw money through ATM. The card can also be used at PoS i.e Point of Sales.

In short, the card can be used,

⦁ To swipe at PoS

⦁ To withdraw cash from ATMs

⦁ As credit card to avail overdraft facility

At present, only a few banks are being able to provide the Mudra Card but it is expected that more and more banks will be joining in as soon as possible. As of now, only Punjab National Bank, Corporation Bank, Kotak Mahindra Bank, Axis Bank, Canara Bank, Allahabad Bank, Vijaya Bank and State Bank of India have come up with Mudra Card.

So, this is all you need to know about MUDRA and the loans offered by it. If you are an entrepreneur and need financial assistance, this is the right place to be.