Investment Planning is a crucial step that aids in wealth growth and income generation. Most investors look for maximum returns with least risk in deciding out the “best” investment option for themselves. However, there is no such “best” investment concept that exists in reality. One can select from the numerous alternatives that are available and make it work best for them.

If you want to figure out the most desirable way of investing your money, consider these factors as a priority:

- Financial goals – whether you are planning to meet your short/long term goals through investment?

- Risk horizon – How susceptible are you when it comes to taking the risk? Low, Moderate or High Risk?

- Investment period – Whether you want to invest for a shorter period or a longer period?

- Investment amount – How much amount you can practically afford to invest out of your entire savings?

There are a variety of investment options in India ranging from like equity, mutual funds, bonds, PPF etc. Here we have chalked out the most desirable investment options in India with varying degrees of risk, that an investor can look up to for financial planning. Though these are less known they do offer good returns.

1. Public Provident Fund (PPF)

Being one of the most popular investment options in India, PPF tops our list.

The best part about PPF is the tax benefit offered under it falls in EEE (exempt-exempt-exempt) tax status. This simply means that the interest earned at the time of investment and proceeds received at maturity are all tax-exempt or free.

- PPF has a lock-in period of 15 years where the date of calculation of maturity is taken from the end of the financial year in which the deposit was made. It does not matter in which month or date the account was opened.

- A minimum contribution of Rs 500 per year and maximum of Rs 1.5 lakh per annum are allowed under PPF.

- The interest rate of PPF gets reviewed every year by the government. It is 7.6% as decided for April-June 2018 quarter. There is provision for partial withdrawals as well as loans under PPF.

K. Ramalingam, the chief financial planner at Holistic Investment Planners says,The present 7.6% interest rate is reasonably a good rate considering the fact that the interest is tax-free. So the real rate of return is high for investors compared to the bank fixed deposits, where interest is taxable.

2. Sukanya Samriddhi Scheme

Under this scheme, a saving account can be opened in the name of a girl child from the time she is born until she turns 10 years old.

- The account can be opened either in a public sector bank or in a post office.

- The minimum deposit for the account is Rs. 1000 and the maximum is Rs. 1,50,0000 in one year. The rate of interest currently is 8.1%.

- The girl can operate her account after she reaches the age of 10. The account allows 50% withdrawal at the age of 18 for higher education purposes.

Deposits in the account can be made till the completion of 15 years, from the date of the opening of the account. It is a good scheme for the girl as it gives her some financial security while being less risky as compared to Mutual Funds and Equity.

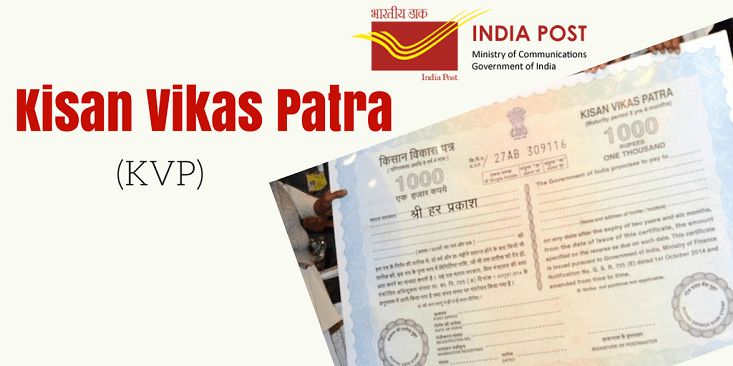

3. Kisan Vikas Patra (KVP)

KVP is another popular certificate scheme provided by Indian Post Office. A KVP doubles one-time investment in a period of approximately 9 years and 10 months (118 months).

Putting it simply, a Kisan Vikas Patra for Rs. 5000 will get you a corpus of Rs. 10,000 post maturity.

Features of KVP

KVP is considered a good choice for risk-averse individuals, who have surplus money, which they may not require in the near future. KVP gives a guaranteed return irrespective of market fluctuation.

- KVP can be purchased from any Departmental Post office by an adult or on behalf of a minor by two adults.

- KVP provides the facility of nomination. In case of nominating a minor, the date of birth is mentioned.

- The interest rate of KVP can vary depending on the number of years invested from the date of purchase. At current, it is 7.8%, compounded yearly.

- KVP is available in denominations of Rs. 100, Rs. 500, Rs. 1000, Rs. 5000, Rs. 10,000 and also Rs. 50,000 for investment. There is no maximum limit.

4. Fixed Maturity Plans (FMP)

- These are close-ended mutual fund schemes that involve debt instruments such as the certificate of deposits (CDs), money market instruments or bonds.

- FMP are considered low-risk instruments as their returns are not guaranteed. However, they have a tax advantage over traditional bank FD’s.

- Capital gains on debt FMPs, held for more than 36 months, qualify for long-term capital gains (LTCG) taxation. Different plans have different maturity periods from 1 year to 5 years depending on the instruments invested in.

5. National Pension Scheme (NPS)

This is a good option for investors who want to look forward to a stable pension post-retirement. Under this, investor’s contributed capital is invested in various assets such as- equity, bonds, government securities etc.

- It comes with two choices: Active Choice and Auto Choice.

- Auto choice mode involves capital distributions in assets based on your age (Life Cycle Fund) while the active choice, the investor decides the ratio in which funds are to be invested in different asset classes.

- The scheme matures when the investors turn 60 years of age where the returns are market linked. The lock-in period also depends on the age of investor.

- The tax benefit under NPS is offered under section 80C for a maximum of Rs 1.5 lakh and an additional tax benefit of Rs 50,000 under section 80CCD (1B).

6. Gold

Gold can take place in various forms such as physical form and digital including jewellery, bullion, sovereign gold bonds, digital gold etc.

However, it is advisable not to invest too much as the prices are subject to fluctuations creating uncertainty.

How much should one invest in Gold?

According to financial planners, says that someone with stable and regular income should not put more than 2-5 percent of their portfolios in the precious metal. And for those who do not have a regular income, they put in not more than 10 percent.

Moreover, for investments, one should consider paper gold options which are more cost-effective and more liquid such as gold exchange-traded funds, fund-of-funds, and sovereign bonds – instead of physical gold.