The Modi Government has been very active in emphasizing the use and inclusion of new and emerging technologies in its digital space for simplifying resource-heavy procedures to trivial tasks like filing the ITR, which was once filled and submitted manually, is now completely online and autonomous.

From huge opportunities in the IT Sector to coordinating community events like professional workshops and hackathons, the government has come a long way ahead of what it was but there’s no way to backtrack the past checkpoints. Not only the central government, but the state governments are also showing exceptional enthusiasm to carry the agenda set by the center regardless the political party the state government belongs to. This has resonated a great momentum to the movement. Experts suggest that this is a remarkable step by the center in building a sustainable future for the people.

Income Tax Return is actually just a form in which you as an assessee file information about your income and tax details to the Income Tax Department of India. Both of the Income Tax Act, 1961, and the Income Tax Rules, 1962, requires the Indian citizens to file returns to the Income Tax Department at the end of every financial year. These returns should be duly filed before the specified due date and failure to do so results in severe financial penalties. ITR Forms vary depending on the criteria of the origin of the income of the assessee and the division of the assessee. Depending on the category of the individual the submissible tax amount varies. You can know more about the various divisions and categories of ITR from the official website of the department.

However, the Income Tax Department imposes certain strict requirements to define the criteria of the tax-compliant-citizens which includes a person but not limiting to in possession of a valid credit, owning any kind of vehicle, occupying a floor of an immovable property, who is a member of a club with entry fees greater than twenty-five thousand rupees or payable to international travel for himself or other individuals which may/not be dependent on the person.

Therefore, filing Income Tax Return every year is very important for every individual who is an assessee or belongs to the community of salaried citizens. And, it’s best to do so before the due date to prevent from enduring extreme financial penalties per notice from the department. However, the returns can be filed belated i.e., post the due date, with a certain financial penalty imposed over the person.

While filing Income Tax Return, it is always better to keep some documents readily available to you like – PAN Card, Bank details, Aadhaar number and other credit and investment documents.

You can easily file your ITR through Income Tax Department’s e-filing portal using these 5 simple steps:

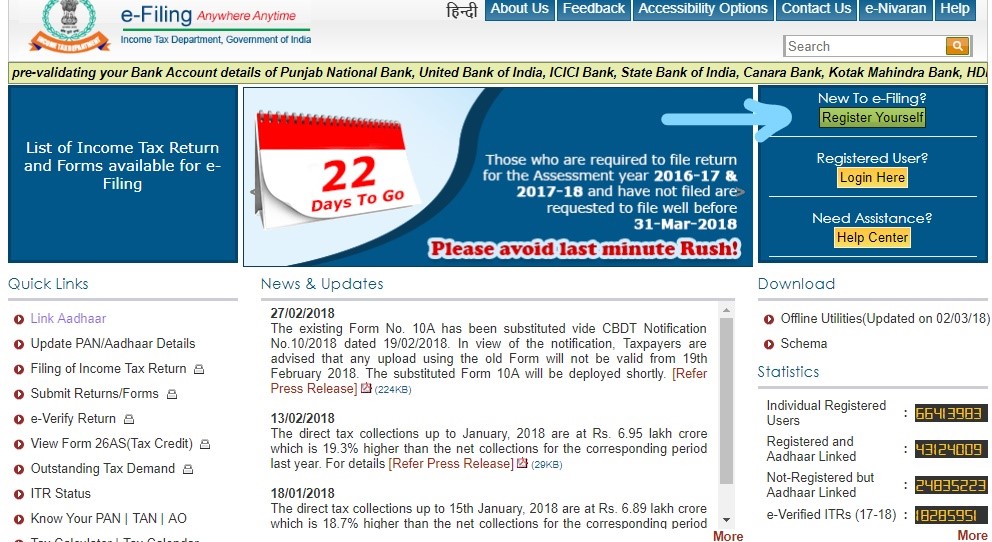

Step 1- Visit the e-filing website at income tax department website. You need have an account registered on the website (using PAN number) in order to proceed with filing your ITR. In case you are already registered, you are required to click on the ‘Login Here’ to proceed further to e-filing portal.

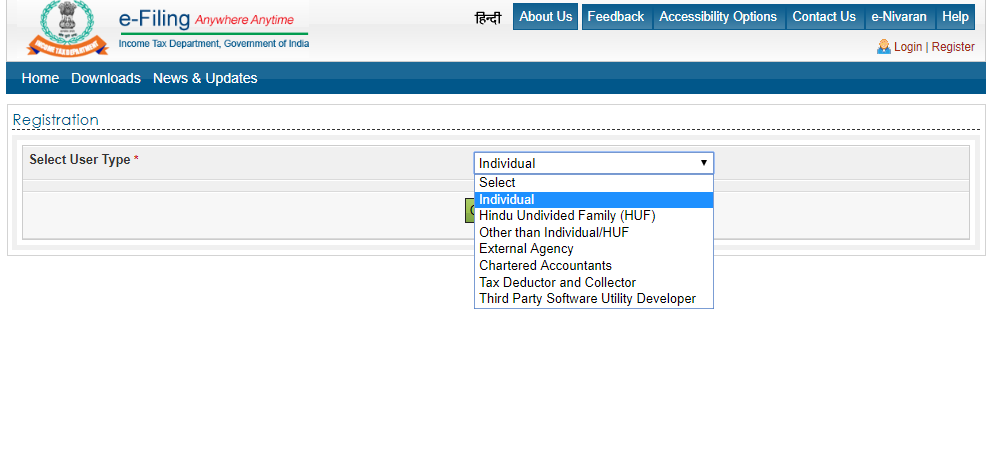

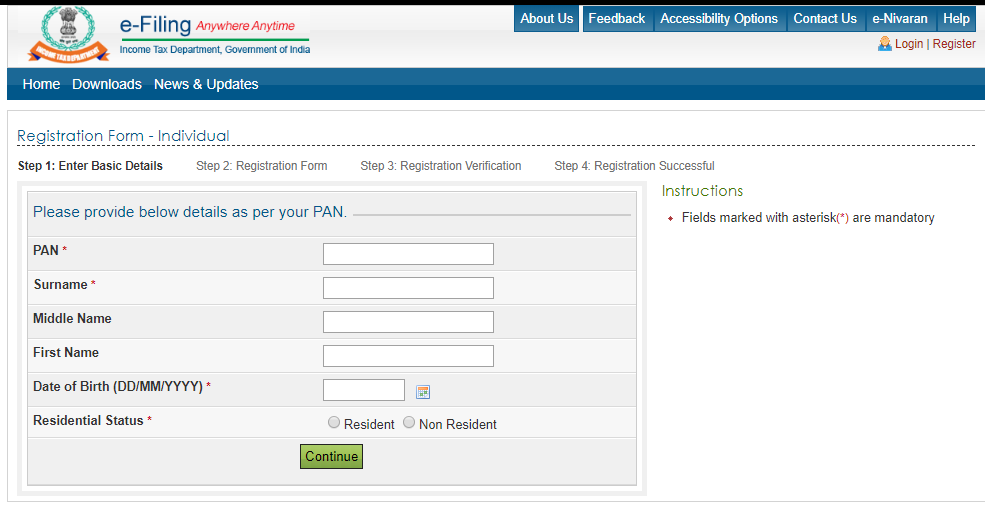

Step 2- Once you will proceed towards the ‘Registered Yourself’ tab and select your user type from the drop-down, you will be directed to the next window where you need to enter your PAN number, surname, middle name, first name, date of birth and residential status. You can fill the particulars similarly for completing the registration procedure. Once done you can login and proceed with filing your ITR.

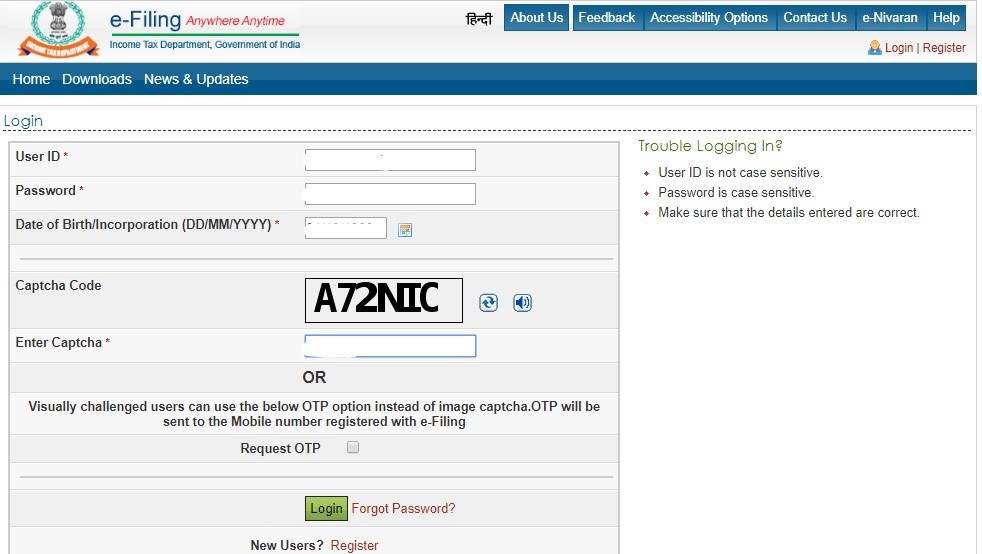

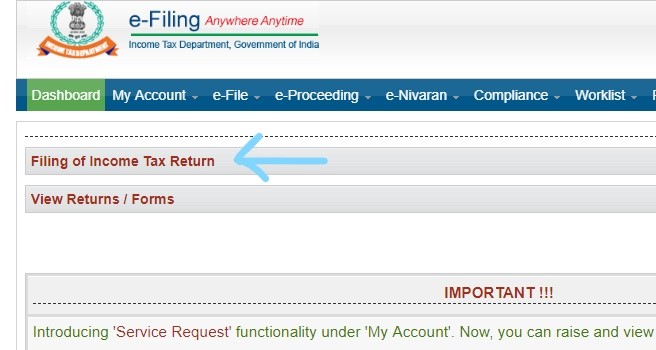

Step 3- After completing registration, press the ‘login’ button from the website homepage which redirects you to fill a form with familiar entries like User ID (your PAN number), password (keep and safe and strong) followed by a captcha code (as soon you enter your PAN number a new entry pops up below the password entry for DOB, don’t forget to fill that too). After entering all the credentials successfully, clicking on the login tab will take you to your profile dashboard window. In this window, you can check your current/previous history of filed ITR’s and also by clicking on ‘Filing of Income Tax Return’ will help you proceed further taking you to a new window where you can file your yearly ITR.

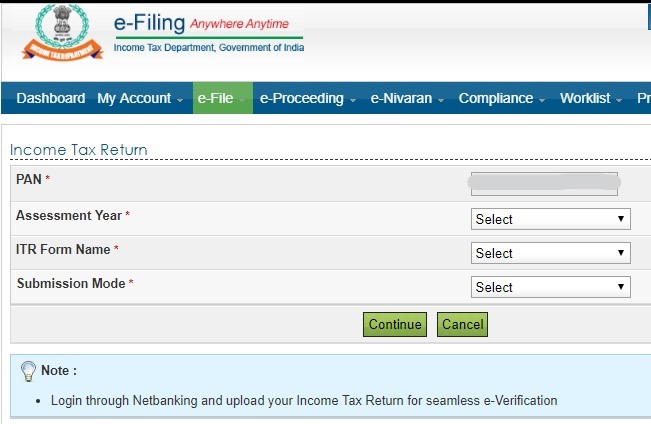

Step 4- Now, when you are ready to file a new ITR, which you can do it very easily. You need to enter your PAN number, select Assessment Year and ITR Form Name which you need to file from respective dropdowns. Salaried employees need to file details in ITR 1 (SAHAJ) in Form Name and finally select the Mode of Submission to almost complete filing your return.

- Once you are done, submit the form and get your acknowledgment receipt within a stipulated time frame. The e-filing system will confirm your ITR submission for the given fiscal year and automatically email you the receipt.