U.S.-based payments app Circle has raised $60 million from Chinese investors and launched a company in China, as it seeks to expand in the world’s second-largest economy.

The latest funding comes from existing investor and Beijing-based tech investment fund IDG Capital Partners, as well as Chinese firms including Baidu, CICC Alpha and Everbright Investments, Circle’s co-founder Jeremy Allaire said.

“We’re not aiming to compete with the domestic market as that would be a suicide mission given the strength of local players like Alipay and WeChat, but we can connect Chinese consumers with the euro zone and dollar markets,” Allaire said.

Circle’s China unit operates as a separate locally incorporated company and has not yet launched a product, pending a deal with a local banking partner and a legal license to operate, Allaire said.

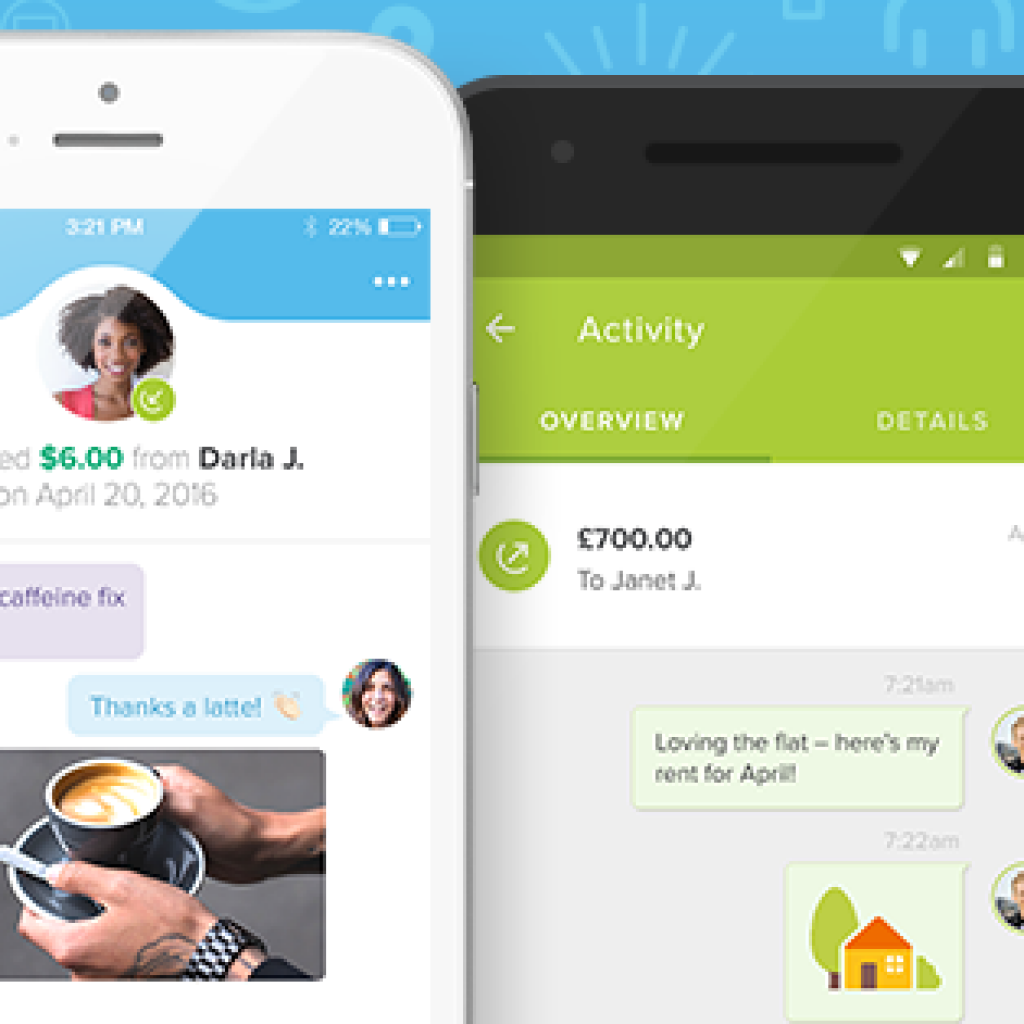

Circle allows the sending of payments to countries where it hasn’t yet launched, with the payment transferred into bitcoin, then settled within minutes via the blockchain network that validates bitcoin transactions. At the other end, the bitcoin is transferred back into the currency of that particular country.

Circle’s aim in China is to connect consumers there with this new global means of making small or ‘social’ payments to peers in other countries.

China has in the past shown wariness towards to the bitcoin virtual currency whose usage underpins some of Circle’s transfer of payments, blocking banks from trading the currency in December 2013 on concerns it was being used for money laundering.

In January this year, the People’s Bank of China said it wanted to launch its own digital currencies to cut the costs of circulating traditional paper money and boost policymakers’ control of money supply.

Circle, which launched in the United States at the end of last year and counts Barclays and Goldman Sachs among its backers, allows cross-currency transfers of pounds and dollars at rates that it says are better than other money transfer services.

The company has now added support for euro-denominated payments in Spain as the first step of a broader euro rollout, Allaire said.