Most investors in SoftBank’s $100 billion Vision Fund want to join the group’s forthcoming second fund, founder and Chief Executive Masayoshi Son said on Wednesday, adding discussions would begin soon.

The entrepreneur said in May a second fund would launch “soon”, with SoftBank likely to be the only investor initially.

Raising further funds is essential if Son is to extend his spending spree on late-stage startups around the world.

Investors in the first fund include the sovereign wealth funds of Saudi Arabia and Abu Dhabi, Apple Inc and Foxconn, formally known as Hon Hai Precision Industry Co Ltd.

The Vision Fund will ramp up its employee numbers to 1,000 from 400 currently, Son said at the group’s annual general meeting.

The fund’s head, Rajeev Misra, said he sees investment rising to 100-150 companies, from around 80 at present.

Internet firms now dominate rankings of the world’s largest companies but have transformed just two industries, advertising and retail, which make up only a small part of the economy, Son told investors.

While SoftBank has invested in those industries in less mature markets – in, for instance, South Korea’s Coupang and Indonesia’s Tokopedia – its tech bets have been focused on startups looking to disrupt other industries like transport, insurance and healthcare.

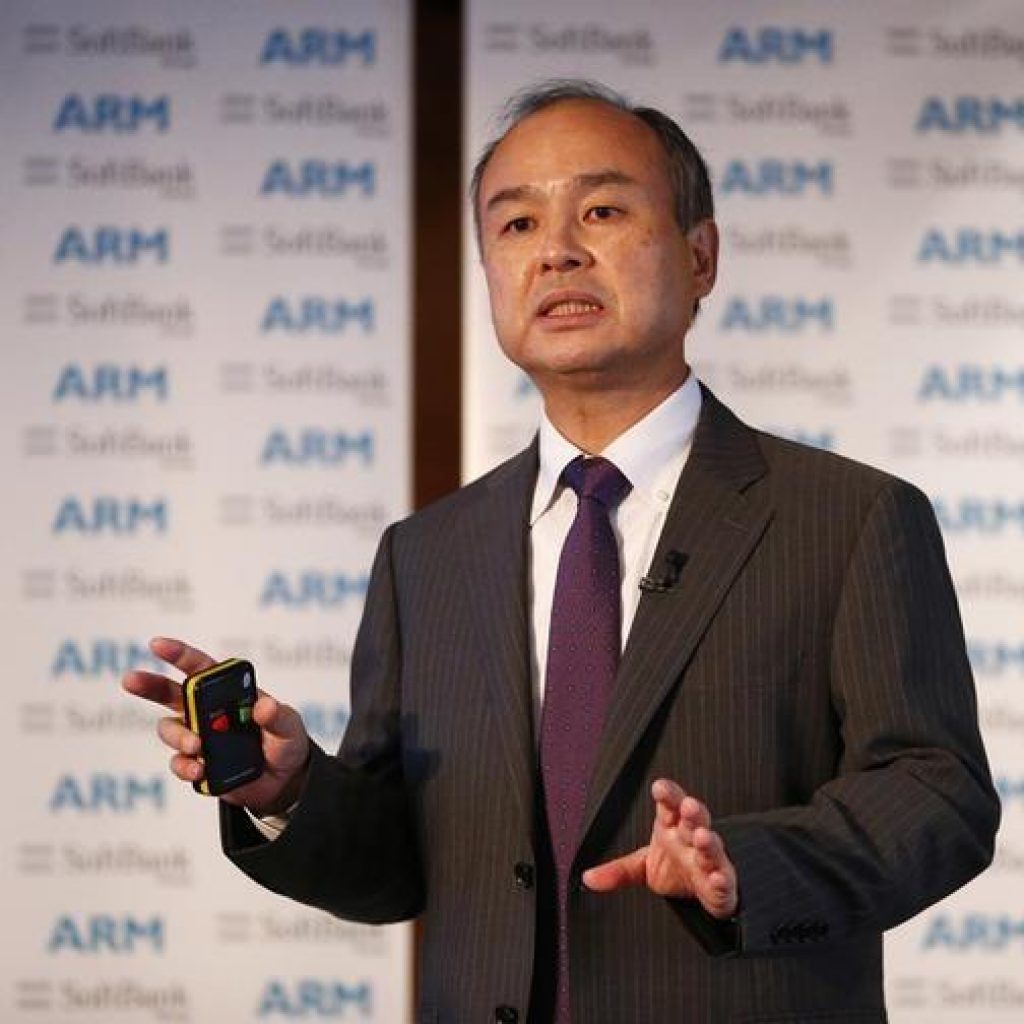

Son also said he wants to be the conductor in an AI-driven technological revolution.

“The conductor doesn’t play anything but actually he plays everything,” Son said.

Shareholder responses at the meeting included a plea for Son to take care of his health, concern over the number of injuries at the Fukuoka SoftBank Hawks baseball team, and from one father who said he had taken his son to SoftBank’s headquarters in the hopes of glimpsing the founder.

Outside the venue in Tokyo, Japan’s taxi lobby protested Son’s support for the ride-hailing industry, which remains strictly regulated domestically.

SoftBank portfolio companies including recently listed Uber Technologies Inc and China’s Didi Chuxing control 90% of the industry globally.