MOUNTAIN VIEW, CALIFORNIA – Abra, the company changing how people use cash and their smartphones to send and receive money around the world, announced that the Abra app will be available to all registered users in the US and Philippines in the coming weeks, with more countries to follow soon. The company also announced their entry into online, digital cash-based merchant payments.

In addition, Abra announced that Ratan Tata, the Chairman Emeritus of Tata Sons, and American Express have made strategic investments in Abra as part of the recently-announced Series A round. These are the first investments in the crypto currency world for both American Express and Ratan Tata.

“As people and businesses transact more globally, there’s a need for more convenient and affordable ways to move money, and we think the blockchain could play an important role in the evolution of money transfer and commerce, especially in emerging markets,” said Harshul Sanghi, Managing Partner, American Express Ventures. “We’re pleased to invest in Abra and to learn more and imagine new possibilities for blockchain technology.”

Abra is also announcing an innovative set of services and features to support global online merchants who wish to accept digital cash via the Abra app as a form of payment. Any merchant who adds the Abra Merchant APIs to their web or mobile app can allow a consumer to pay for any product or service by simply typing in their mobile phone number at checkout. Authorization and settlement happens as soon as the consumer confirms the transaction via the Abra app.

Abra has already been signing up merchants for this new solution and will be demonstrating the service at the Money2020 Conference later this week. Abra expects to begin the global launch of the Merchant API service later this quarter.

“Billions of consumers can’t easily access debit and credit networks for payments and money transfer. Either they don’t have a bank account, they can’t use their bank or card details for online international transactions, they may be traveling to a place where they can’t use the local banking networks, or they are simply concerned about privacy and theft of their banking and payment credentials. Abra foresees the convergence of payments and money transfer for these consumers into a single, global digital cash network that addresses all of these problems,” said Bill Barhydt, CEO and Founder of Abra.

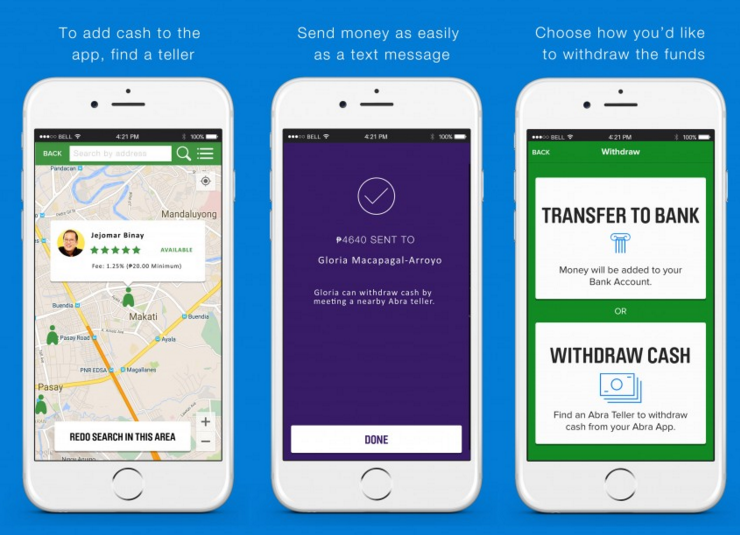

Abra won the Launch Festival in March as Best Overall Company. The Abra app provides for storing digital cash, sending that money to any smartphone and using a new network of human ATMs, called Abra Tellers, who are individuals or businesses earning money by buying and selling digital cash to and from any consumer via the Abra app.

About Abra

Abra is making cash mobile. We enable anyone to store digital cash, valued in any currency, directly on your phone with no bank required. Send cash instantly to anyone with a smartphone, anywhere in the world. Our network of Abra Tellers –individuals or businesses who facilitate the buying and selling of digital cash –makes financial services more accessible for consumers and creates new business opportunities around the world. Abra is available on Android and iPhone.