World’s leading co-working space provider WeWork raises $2 billion from Softbank in a deal that is billions of dollars below what WeWork hoped.

The initial amount that WeWork and Softbank discussed was $20

With the recent funding round, Softbank Group Corp’s invested total $10.4 billion in WeWork including $4.4 billion in 2017 and $6 billion in 2018 and 2019.

The initial plan was to invest $10 billion in SoftBank money to fund WeWork’s growth plans and use another $10 billion to buy out employees and other existing investors, according to a person familiar with the matter. That proposal would have given SoftBank majority control of WeWork.

Reducing the investment leaves WeWork with $1 billion to buy shares from existing investors and means Softbank will not gain majority control, said the person, who was not authorized to discuss the negotiations between the two firms.

The newly promised funds will not include any money from SoftBank’s Vision Fund, whose biggest investor is Saudi Arabia, WeWork said.

SoftBank used some Vision Fund money to make its early investments in WeWork. But recent investments have come solely from SoftBank Group due to political tensions following the death of journalist Jamal Khashoggi and some Fund investors raising concerns about investing too heavily in WeWork, the person said.

In the first three quarters of 2018, WeWork posted a net loss of about $1.22 billion on revenue of $1.25 billion.

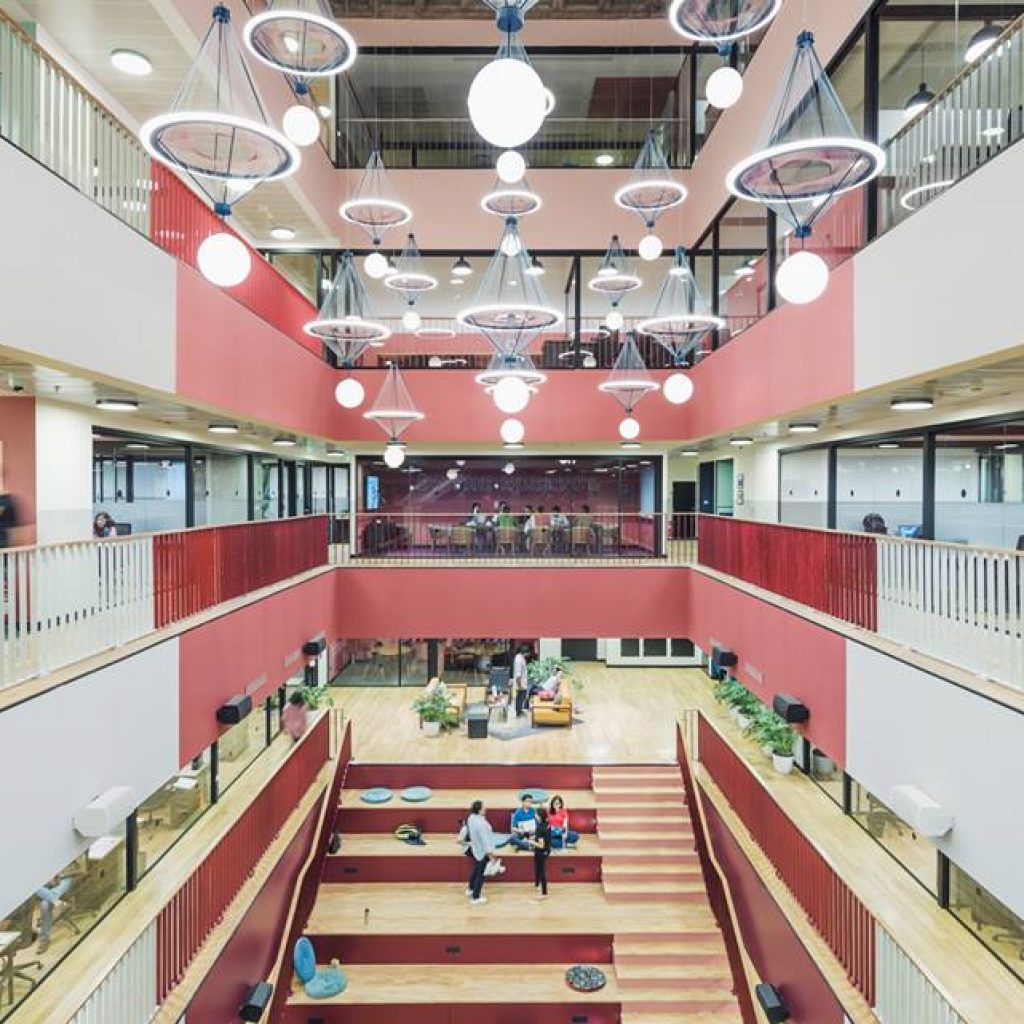

Demand for flexible office space has steadily grown over the past decade, rising to about 11 percent of all leasing in Manhattan last year from about 3 percent several years ago, according to brokerage Colliers International.