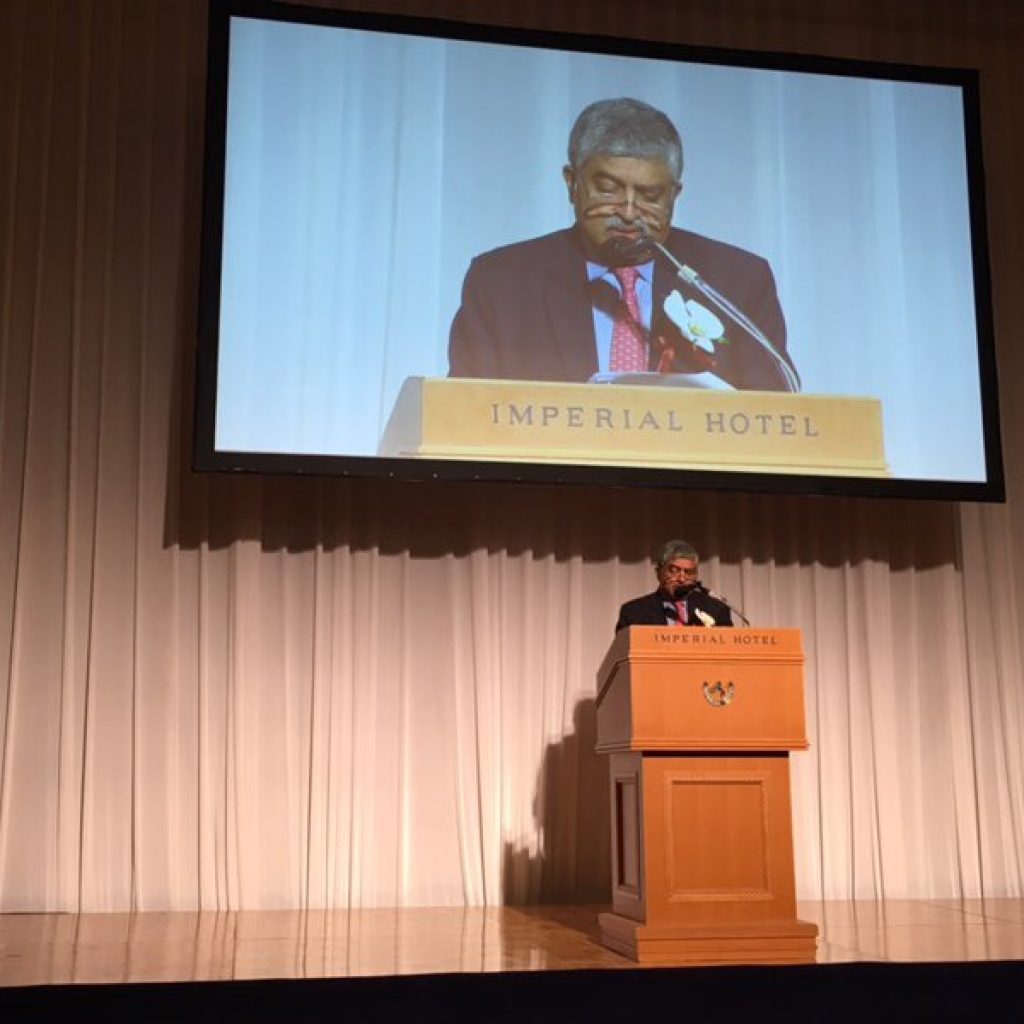

India’s central bank has constituted a panel with Infosys chairman Nandan Nilekani as its head in a bid to deepen digital payments in Asia’s third-biggest economy.

The five-member panel, which includes a former deputy governor of the Reserve Bank of India (RBI), will identify ways to widen financial inclusion via the use of digital payments and suggest measures to “strengthen the safety and security of digital payments”, the central bank said in a statement.

In 2017-18, card payments in India rose 43 percent from the previous year to 10.61 trillion rupees ($151.21 billion), while payments through state-backed unified payments interface rose 16 times year-on-year to 1.01 trillion rupees, according to RBI data released in August.

India’s digital payments are expected to grow five-fold to $1 trillion by 2023, according to Credit Suisse.

Nilekani, a co-founder of India’s second-biggest software services firm Infosys, was also the first chairman of a body that oversees India’s ambitious biometric ID project, Aadhaar.

The RBI, in a rare public move last year, objected to a government-led panel’s recommendation for payments systems to be overseen by a regulator that would be set up outside the central bank’s control.

The RBI on Tuesday also issued guidelines on the use of tokenization – a way to mask sensitive card data with unique symbols or elements – to make contactless card payments safer.