Small Business Employment Watch closed the year with a decline in small business job growth and continued, moderate growth in hourly earnings. The Small Business Jobs Index stands at 98.88 in December, down 0.13 percent for the month and 0.82 percent for the year. At $26.95, hourly earnings in December gained 2.42 percent ($0.64) year-over-year and averaged a growth rate of 2.49 percent for 2018.

“At 98.88, the Small Business Jobs Index continued its decline through the end of 2018, confirming that it’s a difficult hiring environment for the country’s small businesses,” said James Diffley, chief regional economist at IHS Markit.

“With the positives of a strong economic environment and the prospects for growth under tax reform, small employers were challenged throughout 2018 with job growth due to the difficulty of recruiting employees given the historically low rates of unemployment,” said Martin Mucci, Paychex president and CEO.

Broken down further by geography and industry, the December report showed:

- The top regions for employment growth and wage growth, respectively, are the South and West.

- Wisconsin and Arizona are the strongest states for small business job growth; Arizona is the top state for wage growth.

- Dallas remains first among metros in job growth; Riverside, California is once again the top metro for wage growth.

- Hourly earnings growth in Leisure and Hospitality increased 4.02 percent in 2018, best among all industry sectors.

The complete results for December, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at www.paychex.com/employment-watch. Highlights are available below.

National Jobs Index

- The national index has slowed steadily for two years, and the pace of decline accelerated in 2018.

- At 98.88, the national index is down 0.13 percent from November, its seventh consecutive decrease.

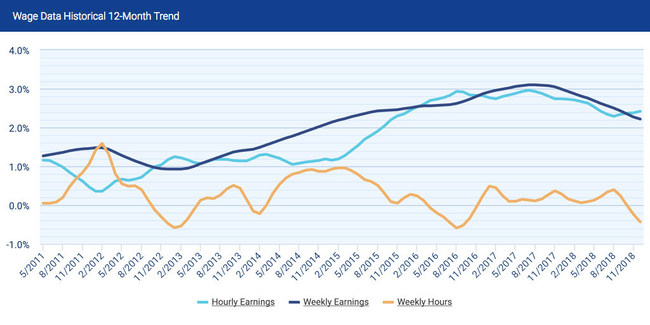

National Wage Report

- At 2.42 percent in December, hourly earnings growth has slowly improved each month since August.

- However, at 2.22 percent, weekly earnings growth has declined, with a reduction in weekly hours worked.

Regional Jobs Index

- The Northeast fell 1.42 percent in 2018 to 98.11, its lowest index level since early 2010.

- The West held its pace of employment growth throughout 2018 as it improved from last to second among all regions, just behind the top-ranked South.

Regional Wage Report

- The Northeast was the only region to not show a year-over-year improvement in its hourly earnings growth rate, declining to 2.14 percent.

- Weekly hours worked growth has decreased sharply during 2018 in the West.

State Jobs Index

- Two states with an index above 100 remain, Wisconsin and Arizona.

- Massachusetts, Pennsylvania, and New Jersey each have indexes below 98.

- California has slowly seen employment growth improve during 2018; the state did not have two consecutive declines all year.

Note: Analysis is provided for the 20 largest states based on U.S. population.

State Wage Report

- Wage trends are mixed across states, with notable decelerations in Arizona, Texas, Indiana, Georgia, and Virginia.

- Though decelerating, Arizona still leads states in wage growth, trailed by California and Tennessee.

Note: Analysis is provided for the 20 largest states based on U.S. population.

Metropolitan Jobs Index

- Dallas and Denver lead all metros in small business employment growth, both well above 100.

- With an index level above 100 at the end of 2017, the pace of employment growth in Boston has slowed 3.25 percent during 2018, down to 97.04.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Metropolitan Wage Report

- Western metros continue to lead wage gains, with Riverside, Phoenix, Denver, and Los Angeles taking the top four spots among metro areas.

- Houston, Atlanta, and Boston are the three weakest metros for hourly earnings growth, all with prolonged declines.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Industry Jobs Index

- Construction slipped below 100 for the first time since 2011, but remains one of the strongest and most steady sectors for small business employment growth.

- Up 0.20 percent to 98.63, Leisure and Hospitality had the best gain in December among industry sectors.

Note: Analysis is provided for seven major industry sectors.

Industry Wage Report

- At $17.01 per hour, Leisure and Hospitality increased hourly earnings $0.66 in 2018, or 4.02 percent, which is best among industries.

- Though job growth stalled in Manufacturing during 2018, weekly earnings growth continues to accelerate, up 3.51 percent in December and fastest among industry sectors.

Note: Analysis is provided for seven major industry sectors.

онлайн займ грин манизайм онлайн до 100000быстрый займ ачинск омск займ денегзайм до зарплаты иркутскзайм онлайн pay ps