The multinational holding conglomerate SoftBank Group Corp. is eyeing to buy shares of Yahoo Japan Corp. worth $2 billion in a complicated deal.

The contract was initiated by Altaba Inc. The company warned a few months back that it would start relieving its 35% stake in Yahoo Japan. Last year, when Yahoo Inc. was sold, Altaba was born so that its profitable stakes in Yahoo and Alibaba Group could be carved out.

According to the deal, SoftBank will buy 11 percent of Yahoo stakes from Altaba. After this, Yahoo Japan plans to buy back its own shares from SoftBank. The entire transaction essentially lets Yahoo Japan remove a major overhang from its stock while keeping its relationship with SoftBank mostly the same.

The whole deal will enable Yahoo Japan to remove a major overhang from its stock, and at the same time keeping its relationship with SoftBank mostly the same.

“No one really expects SoftBank to take a majority stake,” said Kazunori Ito, an analyst at Morningstar Investment Services in Tokyo. “This still leaves the question of what will happen to Altaba’s remaining stake,” he added.

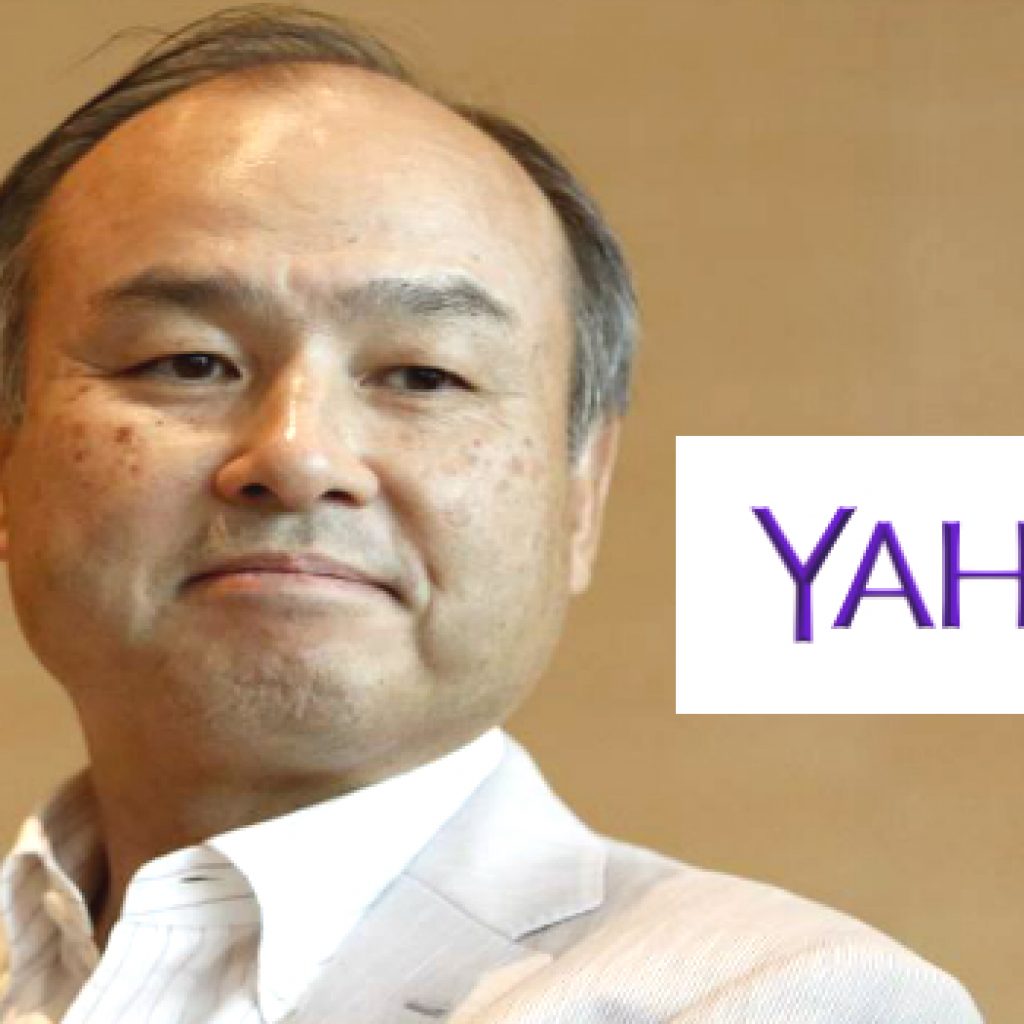

Masayoshi Son, founder of SoftBank had expressed prior to this that he prefers to keep a minority stake in Yahoo Japan. Post the deal, SoftBank’s ownership in the company will remain at about the same point that is 48.17%.

“I have strong confidence in the future performance of Yahoo Japan and I’m excited about the significant synergies between SoftBank and Yahoo Japan, which are consistent with SoftBank Group’s broader strategic synergy group initiative,” said Masayoshi Son.

This deal will also lead to an end to the joint venture agreement between SoftBank and Altaba regarding Yahoo Japan resulting in the resignation of Arthur Chong and Alexi Wellman, Altaba executives from the board of directors of Yahoo Japan.