In the Middle East and North Africa (MENA), the home of oil and Arab princes, the fintech sector is penetrating its roots in the country. Over the past decade, fintech startups in MENA region have raised over $100 million total funding, which is expected to get double by the year 2020.

The net funding raised by these fintech startups in the year 2017 is $24 million alone, an increase of 13percent on the $18 million in disclosed investments in 2016. Among these it PayTabs raised the highest funding of $20 million last year, a fintech startup that provides business solutions to online businesses across the globe. Adding to the sector, YallaComapare (former Comareit4Me) raised a funding of $3.5 million and $1.46 million investment received by Now Money.

Among the latest happenings in the fintech sector in MENA, one of MENA’s first and largest Direct Carrier Billing platform TPay had acquired its competitor- MENA’s second-largest carrier in Egypt, DCBEgypt for an undisclosed sum of amount.

As per the report by the State of Fintech, the number of startups offering financial services in the region doubled from 46 to 105 in the last three years (2013-15). It is also estimated that the number of these fintech startups will increase by over two-folds and can reach as much as 250 by 2020.

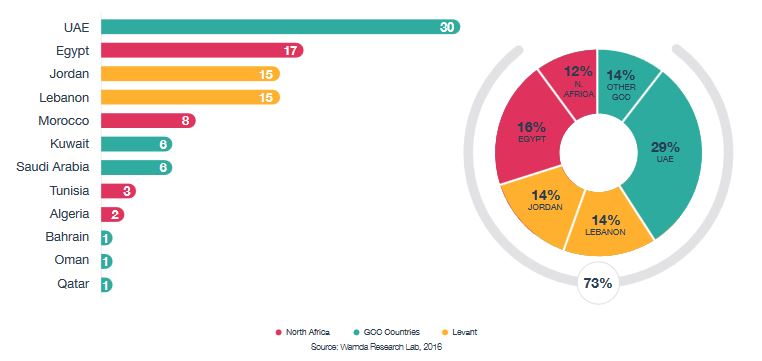

Fintech startups have sprung up in 12 Arab countries, yet 3 in 4 startups are based in the UAE, Lebanon, Jordan or Egypt. The UAE is the most dynamic hub with a 4-year CAGR of almost 60%, and payments are the most popular sector, accounting for half of all MENA-based fintech startups.

“In the Middle East, fintech will emerge as one of the strongest sectors of the economy,” says Al Jouf. “Saudi Arabia’s 2030 vision, which aims to reduce the dependency on oil revenues and diversify the economy by empowering small and medium enterprises, has opened up more opportunities for fintech.”

Dubai, which is considered as the home of fintech startups in the region has seen huge interest by banking assets. Even in November, Dubai International Finance Centre (DIFC) had launched a $100 million fintech-focused fund to and signed an agreement with the Monetary Authority of Singapore to undertake joint fintech projects as per the source Forbes.

Four out of 12 countries host 73% of all MENA fintech startups. These four countries represent MENA’s potential fintech hubs. The concentration in the four hubs reflects the fact that these are the region’s most advanced startup ecosystems, which grew mainly due to governmental support, the involvement of the private sector, good education levels, and political stability.

Here are the fintech startups in MENA.