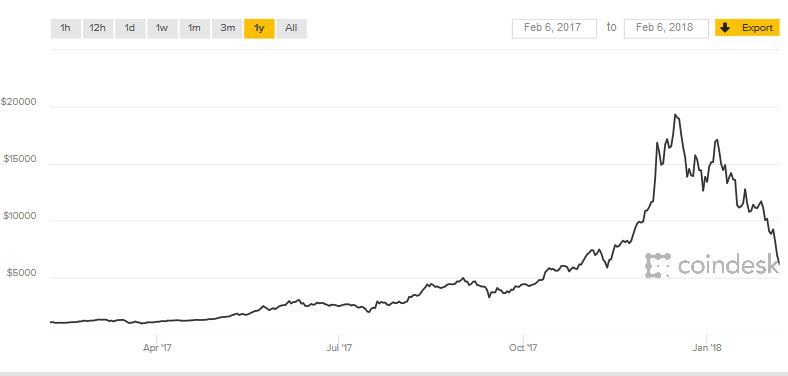

Bitcoin has been tumbling since the past few, and it’s been over 1.5 months that it last it’s all time high. Bitcoin hit an all time high $19,343 in December 16, 2017 after which it fell and topped at $17,135 on January 6, 2018. Ever since then its has been falling and hit $6,083 by IST 10:36 am February 6, 2018.

Investor firms think that it is the time that Bitcoin will have to settle after being too dynamic with its price. The downfall is amidst the raising worries about regulation on the ungoverned cryptocurrency. Even on Friday, Citigroup, JP Morgan Chase and Bank of America said that they will ban cryptocurrency purchase by their credit card customers.

In India, at the time of Union Budget 2018 pre-poll the Finance Minister of India, Arun Jaitley said,”Cryptocurrency is not a legal tender, government will discourage its use.”

A China’s financial daily also reported on Sunday that the authorities will increase their efforts to restrict virtual currency trading platforms, especially those who have moved to overseas locations following Beijing’s ban on initial coin offerings.

Amidst the bans and warnings from the governments on a global scale, Bitcoin is eventually out of favor. Recently online company Stripe said that it is ending bitcoin support. It gives several reasons for doing so: “(Bitcoin) transaction confirmation times have risen substantially; this, in turn, has led to an increase in the failure rate of transactions… By the time the transaction is confirmed, fluctuations in bitcoin price mean that it’s for the “wrong” amount… Furthermore, fees have risen a great deal… making bitcoin transactions about as expensive as bank wires.”

Why is Bitcoin not working as a currency?

Bitcoin never got to prove it’s worth as a currency, the reason- obviously not many companies accepted it for their services. Even a bitcoin conference in Miami refused to accept bitcoin for its attendance fees!

Now from its technology point-of-view it is slow and laborious to use as it verifies transactions in smaller blocks. This however can be taken care of by using bigger blocks or some kind of credit card to ease the burden off the network.

Also, bitcoin relies on people for its mining to verify all its transactions and compensates them by creating new bitcoins, which will soon stop as the number of bitcoins is capped at 21 million.

These problems are overcome by rivals and when the governments will come up with their own digital coins, it will be out of the market very soon.

The other problem why bitcoin did not succeed as a cryptocurrency is the very reason why people invest in it so much- its dynamic value. When you pay something with bitcoin, you don’t actually how much amount you are paying. It may be $5000 when you pay, but a few days later you actually paid somewhere around $6k.

The guy who bought a pizza for 10,000 bitcoins in 2010, or more than US$100 million (S$132 million) based on recent prices, certainly regrets it now! Similarly if you start getting your salary in bitcoins like this Japanese company, you would not know how much you will save by the end of the month. This is the sole reason why you don’t get your salary in terms of the company’s stock you work in. You will never know what the company just paid you!

This is the soul reason why bitcoin never succeeded as a currency. Unless you do something illegal, and cannot accept the money by traditional modes of payments.

But will the bitcoin ever become zero?